Purchase-to-Pay (P2P) process explained

In today's dynamic business landscape, understanding and optimizing the Purchase-to-Pay (P2P) process is more crucial than ever. As organizations strive for efficiency, cost savings, and strengthened vendor relationships, the P2P process emerges as a cornerstone of effective procurement. This article dives into the P2P journey, shedding light on its intricacies, modern challenges, and best practices. Whether you're new to the concept or looking to refine your existing processes, this guide offers valuable insights to navigate the P2P landscape.

What is Purchase-to-Pay?

Purchase-to-Pay (P2P), also referred to as Procure to Pay, is an integrated system that streamlines the entire procurement process for an organization. From the initial ordering of goods or services to the final payment to the vendor, P2P encompasses key stages such as product ordering, budget authorization, receipt of delivery, and invoice processing, ensuring a seamless acquisition and payment flow.

Understanding the Purchase-to-Pay (P2P) process

The Purchase-to-Pay (P2P) process starts with requisitioning, advances through the procurement phase, and concludes with payment. Requisitioning involves the formal act of identifying a specific need for goods or services and documenting it. Procurement takes place when the desired goods or services are received and verified. The purchase-to-pay cycle finishes when the payment is issued to the supplier.

Here's a breakdown of the typical steps in the P2P cycle:

The cycle commences when a buyer identifies a requirement for specific goods or services. This could be based on inventory levels, project demands, or other organizational needs.

Once the need is established, the buyer validates the request with potential suppliers. Suppliers, in turn, provide the buyer with detailed information on pricing, terms, and availability.

Based on the information from suppliers, the buyer raises a requisition for the desired goods or services. This requisition outlines the specifics of the order, such as quantity, delivery timelines, and other pertinent details.

Depending on the organizational structure and the value of the purchase, some requisitions might require managerial approval or budget allocation. This step ensures that expenditures align with the company's financial plans and policies.

Once the requisition receives the necessary approvals, a Purchase Order (PO) is generated and sent to the chosen supplier. The PO serves as a formal contract between the buyer and the supplier, detailing the terms of the purchase.

Upon receiving the PO, the supplier processes the order and ensures the timely delivery of the requested goods or services.

Typically, upon successful delivery, the buyer acknowledges the receipt of the order, ensuring that the delivered items match the specifications in the PO.

After the delivery confirmation, the supplier raises an invoice, referencing the PO number. This invoice provides a detailed breakdown of the goods or services provided, along with the associated costs.

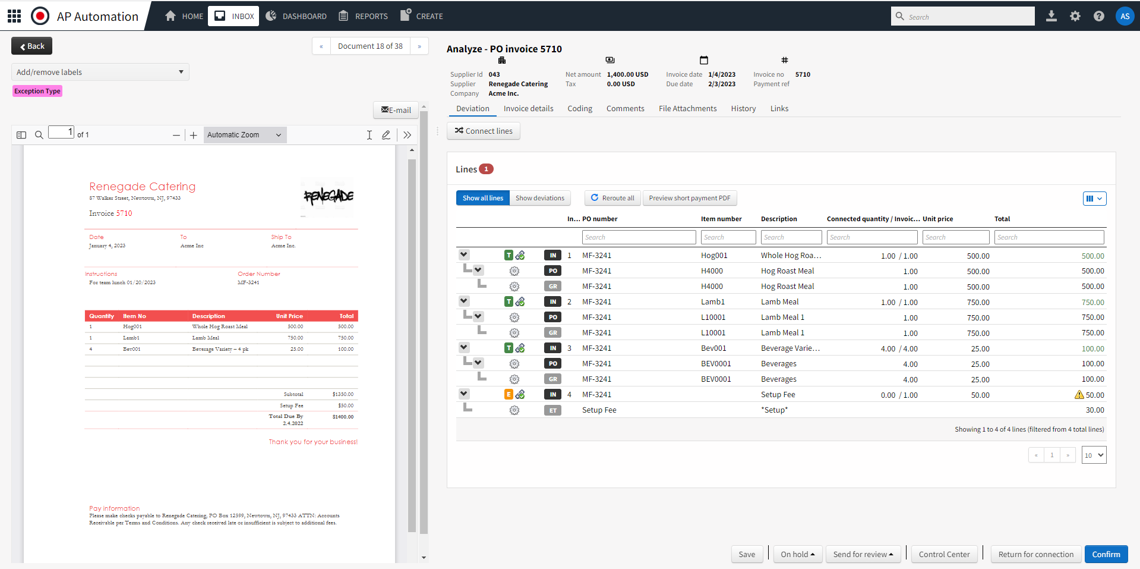

Before making the payment, the buyer validates a 3-way match, ensuring consistency between the PO, the delivered goods or services, and the invoice. Once this match is confirmed, the buyer processes the payment, completing the P2P cycle.

What is a 3-way match?

A 3-way match is a methodology used by the accounts payable or finance team when processing invoices received from suppliers. This is a great way for organizations to safeguard their assets, as it helps them to avoid fraudulent invoices or pay the incorrect amount. The AP team checks the following documents for a 3-way match:

- The invoice issued by the suppliers to the buyer

- Purchase order raised by the buyer

- The goods receipt note

Once there is a match in terms of the quantities, price per unit and terms and conditions, the invoice is validated, and payment can be processed.

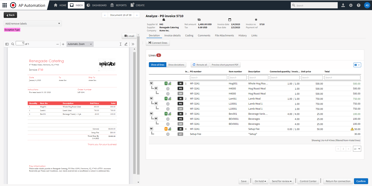

Online Purchase-to-Pay software systems

So now you should have a clear understanding of the P2P procurement process. As for a P2P system, more commonly known as an electronic procurement system, it basically does all the steps mentioned above with full automation, which means no more manual data keying in or knocking on your boss’ door asking for approval. When a requisition is initiated, the P2P procurement system seamlessly directs it to the appropriate individual for authorization. This streamlines the Purchase-to-Pay cycle, ensuring that POs and goods receipts are promptly dispatched to suppliers. Furthermore, the system effortlessly manages the 3-way match, making the entire process virtually hands-free.

In fact, P2P supply chain processing accounts for nearly one-third of the overall cost of the finance and procurement operations, and the best-of-breed system can help boost administrative efficiencies and reduce such costs by as much as 80%.

P2P management software also helps organizations ensure spend compliance and reduce maverick spend. With a purchase order system, employees find and select goods and services for purchase really easily, just like how you do your online shopping, whether on the platform or through controlled access to remote supplier websites. With this guided shopping experience, organizations can ensure their employees are always buying from the right suppliers at the right price, and subsequently, reduce the dreaded maverick spend.

What should you consider before implementing a P2P system?

Initial investment

While there's an upfront cost, the return on investment can be realized quickly with the efficiencies a P2P system brings.

Stakeholder discussions

Engage different stakeholders within the organization to gather insights and address concerns about the P2P system.

Training and resources

Allocate time for training sessions, provide user materials, and establish internal communication programs to ensure smooth adoption.

Detailed project planning

Dedicate time and resources to create a comprehensive project plan. This will ensure successful implementation and high user adoption rates.

At this point, you probably won’t be surprised to hear that we have an eProcurement system that encompasses all of these considerations.

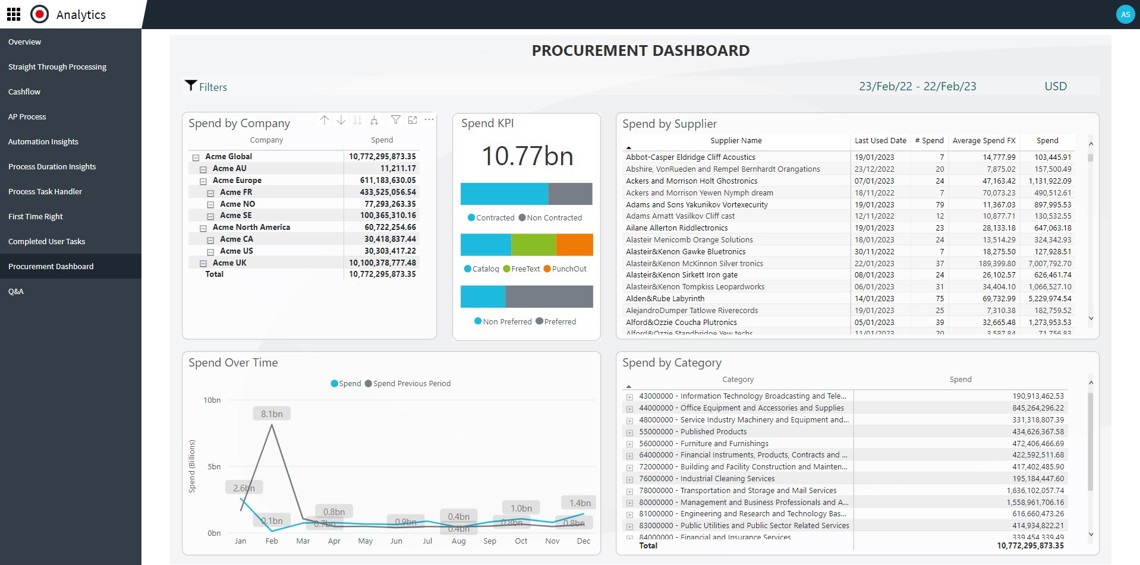

The complexity of modern P2P in enterprise-level businesses

As businesses grow, the intricacies of the p2p process become more evident. Gone are the days of simple paper-based workflows. With the rise of digital transformation, companies are now leveraging technologies like AI and automation to streamline and optimize the steps of the Purchase-to-Pay process.

The importance of order confirmation and delivery notification

Effective communication with vendors about stock levels and turnaround times is crucial. Confirming orders and acknowledging deliveries not only ensures smooth operations but also strengthens the p2p cycle, reducing potential discrepancies and disputes.

Digital transformation in procurement

Relying on outdated procurement solutions can be a bottleneck for many businesses. Embracing digital solutions, especially p2p process automation, can lead to significant efficiency gains. Recent statistics show a growing trend towards the digitalization of the Purchase-to-Pay process, with many companies reporting cost savings and improved vendor relationships.

Integration with key ERP platforms

Integrating the P2P process with major ERP platforms is essential for achieving optimal efficiency and transparency. Medius recognizes this need and offers specialized solutions for various ERP systems. Here's a closer look at how Medius enhances the P2P process across different platforms:

- SAP integration: Integrating the p2p process in SAP can significantly enhance the efficiency of the procurement cycle. Medius offers tailored solutions for SAP, ensuring seamless operations and real-time data access.

- Microsoft Dynamics integration: Medius's solutions for Microsoft Dynamics bring out the best in the p2p process, offering streamlined workflows and enhanced reporting capabilities.

- Oracle Netsuite integration: With Medius's integration solutions for Oracle Netsuite, businesses can experience a more transparent and efficient Purchase-to-Pay process, reducing manual interventions and errors.

- Oracle JDE integration: Medius provides solutions tailored for Oracle JDE, ensuring that the p2p process is optimized for maximum efficiency and compliance.

Best practices for modern P2P systems

Designate a specific individual or team as the primary contact for vendors. This centralization ensures clear communication, reduces misunderstandings, and fosters stronger vendor relationships.

Single point of contact for vendors

Streamline workflows and reduce unnecessary steps. A simplified process not only speeds up procurement but also reduces the chances of errors.

Simplify the procurement process

The success of any process change or implementation often hinges on the support from top management. Their buy-in can facilitate smoother transitions, allocate necessary resources, and drive organizational alignment.

Ensure top management support

The business environment is ever-evolving. Regular reviews ensure that your P2P process remains relevant, efficient, and aligned with the company's goals. This proactive approach can lead to continuous improvements and innovations.

Regularly review the P2P process

Wrapping up the Purchase-to-Pay journey

In today's fast-paced business environment, staying updated with modern p2p process practices is not just beneficial—it's essential. Embracing digital transformation in procurement and integrating with key ERP platforms can set the foundation for sustainable growth and profitability.

Discover Medius's expertise in Purchase-to-Pay

Looking to optimize your Purchase-to-Pay process?

Medius offers cutting-edge solutions tailored to streamline and enhance every step of the P2P journey. Learn more about how Medius can elevate your procurement operations.

Purchase-to-Pay (P2P) FAQs

The purchase-to-pay (P2P) process is an integrated system that covers the entire procurement journey, from the initial requisitioning of goods or services to the final payment to the vendor

Procure-to-pay is another term for the purchase-to-pay process, emphasizing the procurement aspect of acquiring goods and services and then paying for them.

- Needs Identification

- Supplier Validation

- Requisitioning

- Approval and Budget Authorization

- Purchase Order Issuance

- Order Fulfillment and Delivery

- Delivery Confirmation

- Invoicing

- 3-Way Match and Payment

Another term for "purchase to pay" is "procure-to-pay" or simply "P2P."

Purchase to pay streamlines procurement operations, enhances financial controls, reduces errors, and can lead to cost savings and improved vendor relationships.

Risks include manual errors, fraudulent activities, non-compliance with company policies or regulations, and miscommunication between departments or with vendors.

The three-way check involves validating the consistency between the purchase order, the delivered goods or services, and the invoice before issuing payment.

Key stakeholders include procurement teams, finance departments, approvers or managers, and vendors or suppliers.

Automation enhances efficiency, reduces manual errors, speeds up approval workflows, and provides real-time insights into procurement data.

Integration with ERP systems centralizes data, streamlines workflows, ensures real-time data access, and enhances overall procurement efficiency.

Best practices include regular process reviews, adopting automation, ensuring clear communication channels, and continuous training for staff.

Businesses can reduce errors by adopting automation, implementing stringent approval workflows, regular audits, and training staff on best practices.

While P2P focuses on the procurement and payment processes, Source-to-Pay (S2P) encompasses a broader range, starting from sourcing suppliers to the final payment, including supplier management and contract management.