AI in accounts payable: stop buying faster horses

By Luke Mancini, Senior Enterprise Account Executive at Medius

For decades, your finance back office has operated like a well-oiled assembly line. It was all about lining up people in the right order to process tens of thousands of invoices. But even the best assembly line has a flaw: it can only look forward. It cannot look back in time or analyze across data sets without a heavy, time-consuming lift.

This is where Artificial Intelligence (AI) changes the game. AI goes beyond a better workflow or a faster scanner. It’s a fundamental shift in how your finance team operates.

Think of traditional AP automation like a horse. When Henry Ford introduced the car, people weren't asking for an internal combustion engine; they just wanted a faster horse. Today, many finance leaders are still trying to breed faster horses by digitizing paper processes without changing the underlying logic.

AI-powered AP automation is the car. It doesn't just move faster; it reimagines the journey entirely.

The problem with "digital paper"

Most organizations believe they have modernized because they scanned their invoices or shifted to majority of PDF invoices. But what that boils down to is simply swapping physical filing cabinets for digital folders. You are still moving invoices around like paper, just on a screen.

This approach fails because it relies on static rules. If a vendor changes their invoice layout, your Robotic Process Automation (RPA) script breaks. Someone has to go in, fix the code, and restart the process. That isn't intelligence; that's a fragile patch on a leaking pipe.

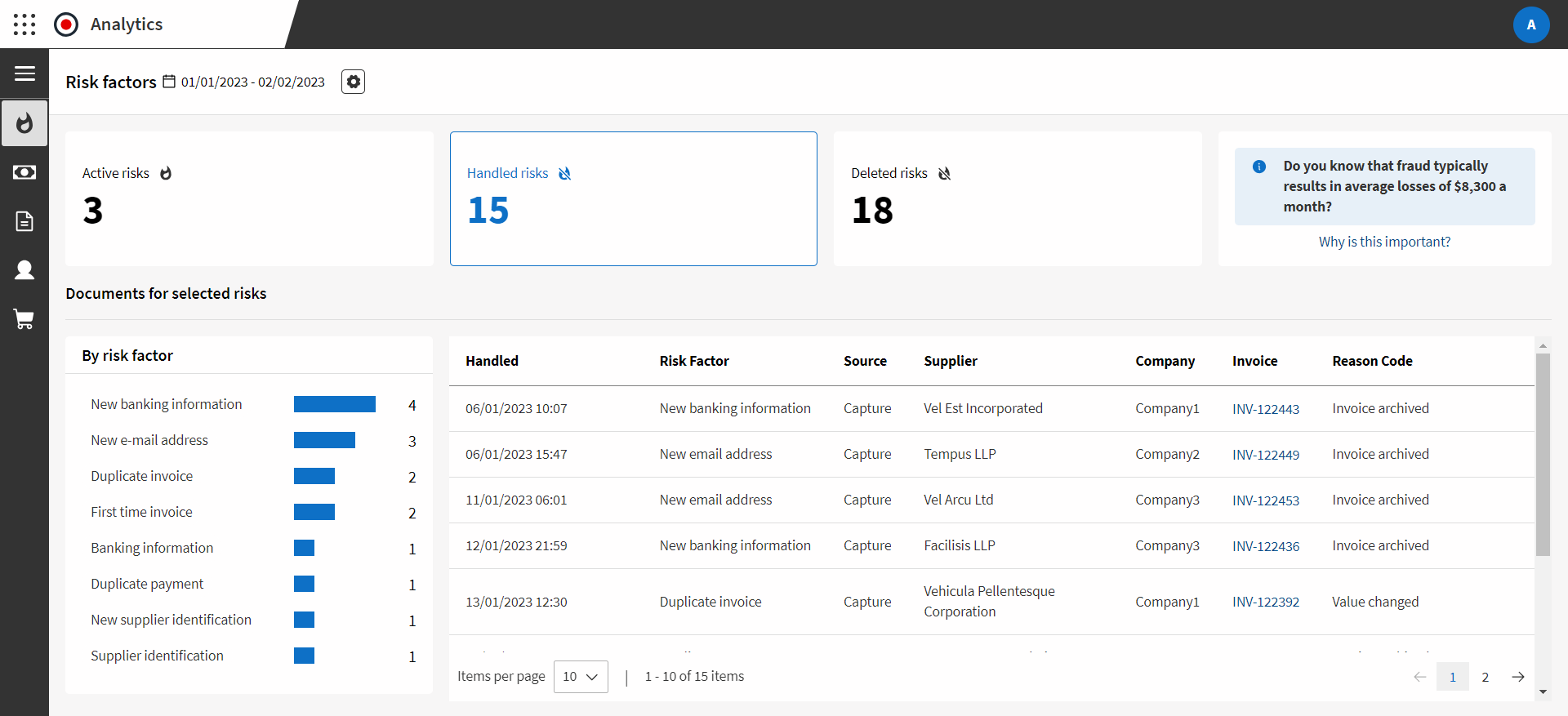

AI offers a level of visibility that legacy software never could. It sees every document the moment it arrives and instantly compares it against everything else in your ERP system. It doesn't just follow a rule; it recognizes patterns. It knows if an invoice looks suspicious, if a PO number is missing, or if a supplier is sending invoices to the wrong email address.

More importantly, it self-reports. A true AI solution will tell you, "I have a problem with these five vendors, and here is exactly why." That is the difference between a limited tool and an intelligent partner.

The $1.4 million duplicate invoice

Outdated systems cost you more than inefficiency, it lets actual cash walk out the door.

Consider a real-world scenario involving a large multinational corporation. They had sophisticated teams and checks in place, yet they missed a single duplicate invoice. It wasn't fraud; it was an innocent mistake where an invoice was routed to two different shared service centers.

The result? They double-paid $1.4 million.

They didn't catch the error until six months later during an audit. Even if you recover that money, it’s been gone for half a year. If you have to hire a recovery agency, you are losing 20-30% of that capital in fees. Preventing that single error would have paid for a global AI implementation.

This is the power of AI. It catches the needle in the haystack because it can see the entire haystack at once. It recognizes that invoice A looks identical to invoice B, even if they arrived months apart or through different channels.

Addressing the fear: Is AI safe?

When finance leaders consider moving from the "horse" of traditional AP to the "car" of AI, the first question is often about safety. Is the gas tank going to explode? Is it risky?

These are valid concerns. You deal with governance, compliance, and security daily. You cannot afford to play fast and loose with company data.

The good news is that enterprise-grade AI is built for this. It respects privacy boundaries. The data used to train the models isn't shared with your competitors. It stays within your organization’s walls, maintaining strict audit trails and governance standards.

Just like we eventually learned that cars don't magically blow up on the highway, finance leaders are realizing that AI is a secure, reliable vehicle for AP operations. It delivers invoices through the process faster, cheaper, and safer than the old horse-drawn buggy ever could.

The "artificial intern": Enhancing, not replacing

There is a pervasive myth that AI is coming for everyone's jobs. In accounts payable, the reality is quite different. AI doesn't replace your people; it liberates them.

Think of AI as a 17-year-old "artificial intern." It has boundless energy and a great attitude. You tell it to do something once, and it will do it a thousand times without complaining. But when it sees something it doesn't recognize, like a strange invoice or a potential compliance issue, it raises its hand and asks for an adult.

That "adult" is your AP professional.

Instead of spending their days keying in data or fixing broken RPA scripts, your team focuses on high-value exceptions. They become strategic problem solvers. This shift allows your AP staff to move away from menial tasks and toward career-building work that adds real value to the business.

From cost center to strategic asset

When you clear the noise and automate the repetitive work, something amazing happens: you get clean, real-time data.

Suddenly, AP stops being a back-office cost center and becomes a strategic lever for the CFO. With real-time reporting, you can manage cash flow dynamically, down to the minute. You can see exactly where money is going and make informed decisions about payment timing and capital allocation.

This visibility transforms the department. You’re not being judged on how many invoices you processed today. You are judged on how well you managed working capital for a specific business unit. That is a massive leap forward for the finance function.

How to get started

If you are a finance leader looking to make this transition, you don't need to boil the ocean. You don't need to rip out your entire ERP system tomorrow.

Start with the problem child

Identify the part of your AP process that hurts the most. Is it a specific set of suppliers? A particular region? High overhead costs?

Challenge your vendors

Go to AI providers and ask them to fix that specific problem. Make them prove the technology works on your toughest cases.

Ensure safety

Verify that the solution is enterprise-grade. Ask about data privacy, audit trails, and security certifications.

Forget the network

You don't need a closed network or a perfect procure-to-pay environment to start. Modern AI can layer on top of what you have and start delivering value immediately.

The future of finance is about working smarter, not harder. The technology exists today to turn your AP department into a proactive, strategic powerhouse. It’s time to trade in the horse for the car.

Explore more AP insights on the

Finance Forward podcast

This blog post was based on an episode of the Finance Forward podcast, hosted by two of Medius's own AP automation experts. Check out the episode that inspired this article, and others, in our podcast library.