How AI is enhancing OCR to enable touchless invoice processing at scale

- Introduction

- The limitations of traditional OCR in invoice processing

- How AI improves invoice capture and data validation

- Enabling touchless invoice processing at scale

- Adapting to real-world complexity with AI

- Reducing manual intervention and strengthening AP efficiency

- Building the foundation for scalable AP automation

- Why finance leaders choose Medius for touchless invoice processing

Hear what's covered in this article:

E-invoicing has evolved far beyond simply converting paper documents into digital files. For finance and accounts payable teams managing thousands of transactions each month, the next frontier is achieving truly touchless invoice processing. At the heart of this evolution is a powerful pairing: traditional Optical Character Recognition (OCR) technology combined with artificial intelligence.

OCR has long played a role in automating invoice capture, enabling systems to scan and extract text from scanned images or PDFs. But on its own, OCR has always come with limitations. It can struggle with layout inconsistencies, image quality issues, and non-standard invoice formats. Extracted data often requires manual review and correction, especially in complex environments where accuracy is critical.

This is where agentic AI steps in to elevate OCR from a static extraction tool to a dynamic, intelligent engine capable of adapting, learning, and scaling. How? By dynamically correcting errors and optimizing workflows in real time, reducing the need for human intervention. Let's explore more.

The limitations of traditional OCR in invoice processing

OCR has provided a foundation for digital invoice capture, but it was never designed to fully automate the accounts payable lifecycle. Many finance teams still rely on staff to clean up OCR output, validate fields, and route exceptions. This can be a significant task for staff, particularly when the OCR hinges on rigid templates for categorizing scanned invoice data. The more diverse the supplier base, the more variation exists in invoice layouts, increasing the potential for errors.

Common OCR challenges include:

- Inaccurate character recognition

- Misaligned or missing data fields

- Heavy reliance on custom templates

- High manual review volume

Another challenge is handling handwritten or poorly scanned invoices, which traditional OCR often misreads. Agentic AI-enhanced OCR can actually interpret handwriting, detect smudges or skewed layouts, and even infer missing data from context.

While helpful for digitizing invoices, OCR cannot ensure data quality or eliminate manual tasks. For organizations seeking straight-through processing, OCR alone does not go far enough.

How AI improves invoice capture and data validation

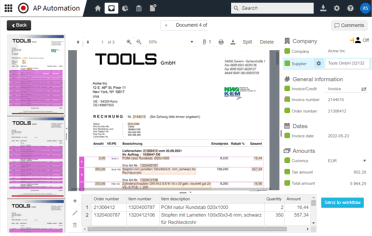

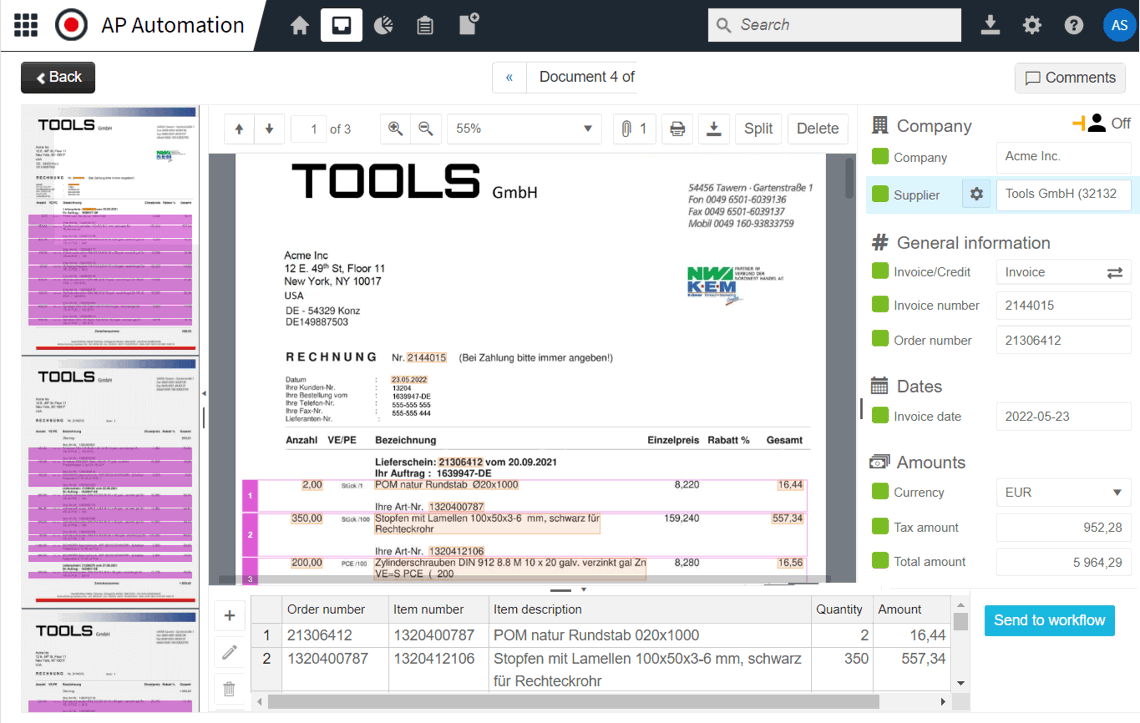

AI innovation is transforming invoice automation by transforming how data is extracted, validated, and processed. Machine learning models can recognize and adapt to different invoice formats, improving over time with every document processed. Instead of relying on fixed templates, AI interprets context and patterns to identify key information accurately, and with Agentic AI, the system can autonomously adjust to new invoice formats or anomalies without human input.

What sets AI apart?

Identifies context (e.g., invoice number vs. PO number)

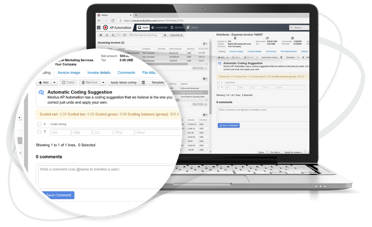

Flags duplicates and anomalies automatically

Reduces reliance on layout-specific templates

Continuously improves with each invoice processed

Agentic AI proactively optimizes workflow and exception handling as it learns

By embedding machine learning into the invoice capture process, companies reduce the need for manual data correction and accelerate throughput. The result is cleaner data, fewer errors, and faster approvals.

AI-driven AP automation for modern finance teams

If you invested in traditional AP automation but still find yourself mired down in manual invoice handling, you're not alone. Traditional tools only take you so far. AI-driven AP automation is built to fight fraud, increase efficiency, and scale with your organization as it grows. See how AI is bridging the gap from outdated technology and helping companies achieve up to 99% touchless processing in this buyer’s comparison guide.

Enabling touchless invoice processing at scale

The goal of modern AP automation is touchless processing: invoices move through capture, validation, matching, and approval without human intervention. AI-enhanced OCR is central to this vision.

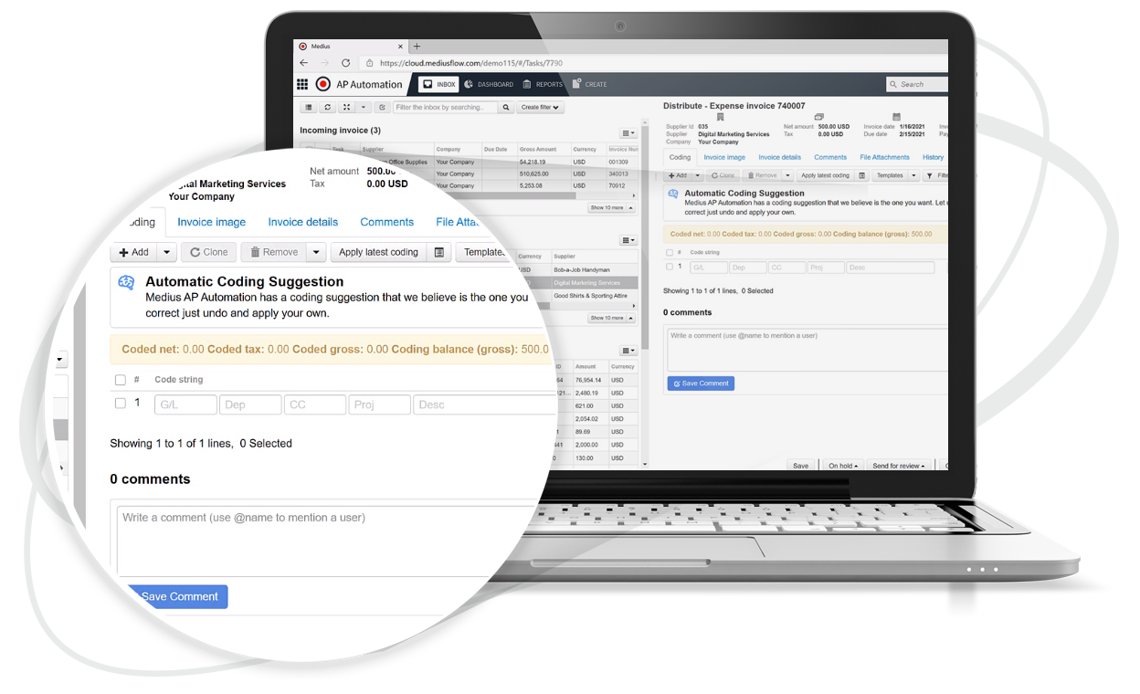

Touchless workflows start with intelligent capture. Invoice data capture is part of AP automation, serving as the first step in streamlining the entire invoice lifecycle. AI interprets invoice data in real time, compares it against purchase orders and receipt records, and routes it for straight-through processing. Where Agentic AI is present, the system can autonomously detect inconsistencies, suggest corrections, and optimize invoice routing without human intervention.

This level of automation is especially valuable for organizations processing tens of thousands of invoices each month. It reduces workload on AP teams, shortens cycle times, and minimizes errors that can delay payments or damage supplier relationships. It also enables teams to scale operations without increasing headcount.

Adapting to real-world complexity with AI

Real-world invoices are rarely uniform. Suppliers use different formats, currencies, tax rates, and languages. Government mandates introduce evolving standards, from structured XML files to localized compliance requirements. AI provides the agility needed to manage this complexity without constant reconfiguration.

Unlike rigid rule-based systems, AI learns from data patterns. Agentic AI adapts as supplier formats change, improving recognition accuracy and exception handling over time. This makes it ideal for environments with high variability and compliance demands.

A solution like Medius’s invoice capture applies agentic AI to decode the structure of each invoice, extract key data points, and ensure it enters the system cleanly. This enables organizations to move beyond PDF-based processes and toward structured e-invoicing without requiring major IT effort.

Reducing manual intervention and strengthening AP efficiency

Manual intervention introduces delays, inconsistencies, and costs. Each time an AP team member must correct a field, escalate an issue, or chase a missing PO, the value of automation diminishes. AI-enhanced OCR helps remove these bottlenecks.

With AI-enhanced (and agentic AI) invoice automation, organizations gain:

Fewer exceptions requiring human touch

Faster cycle times for approvals

Improved invoice data integrity

Greater AP team productivity

Advanced invoice automation platforms combine AI, OCR, and built-in validation rules to ensure that the majority of invoices are processed without touch. Exceptions are flagged with context, so AP teams can resolve them quickly. As the system learns, the number of exceptions continues to fall, and AP teams spend more time on high-value work like forecasting and supplier strategy.

This improvement is not theoretical. Enterprises using Medius have reported faster processing cycles, better data integrity, and measurable reductions in manual handling. The combination of intelligent capture, matching logic, and integration with AP workflows delivers a significant performance advantage.

Burned out teams don’t build

a better finance function.

Over half of finance professionals say they’re unhappy in their roles, citing outdated tools and manual tasks as top reasons. Investing in modern AP automation isn’t just a tech upgrade—it’s how finance leaders retain top talent, boost morale, and reduce costly churn.

Keep your best people by giving them the tools they deserve.

Building the foundation for scalable AP automation

Touchless invoice processing is not a one-time achievement. It requires a platform that continuously learns, adapts, and evolves alongside business needs. AI-enhanced OCR is a foundational piece of this puzzle, turning static document scanning into intelligent, end-to-end automation. Agentic AI ensures the system proactively optimizes capture, validation, and workflow without ongoing human adjustment.

Organizations evaluating AP automation platforms should look for solutions that apply AI throughout the invoice lifecycle. Tools that support real-time capture, data validation, and automated invoice matching are essential. Platforms like Medius offer these capabilities through purpose-built solutions that integrate seamlessly with ERP systems and support global compliance requirements.

For finance teams ready to modernize their processes, intelligent invoice capture is more than a convenience. It is a strategic investment in agility, accuracy, and efficiency at scale.

What is agentic AI, and how does it work?

Why finance leaders choose Medius for touchless invoice processing

Medius enables finance teams to reduce manual workloads, improve invoice accuracy, and accelerate approvals while also maintaining compliance across global operations.

Teams managing high volumes of supplier invoices rely on Medius to drive efficiency without compromising control. With scalable architecture and built-in support for real-time validation, Medius is designed to evolve with your business and regulatory needs.

Book a demo to see how Medius can help your team eliminate manual effort and achieve touchless invoice processing at scale.