Invoice approval is the process of reviewing and approving supplier invoices before recording them in the ERP system and sending them for payment. It’s an important step in accounts payable (AP) that ensures invoices are accurate, legitimate, and compliant before payments are made.

Modern AP automation tools simplify this process. With artificial intelligence, these tools can guide users through approvals, flag issues early, and automatically highlight important invoice details. This leads to quicker, more accurate approvals with less effort.

How the invoice approval process works

The invoice approval process typically includes these steps:

You can enter invoice data manually or capture it automatically. Manual entry often leads to delays and errors, while automated capture, powered by AI, extracts key data from PDFs, images, and emails quickly and accurately.

Invoices are checked against POs or receipts to ensure the supplier, amount, and items match. AI simplifies this process by learning from previous invoices and improving accuracy over time, helping you prevent overpayments, duplicates, and audit issues.

When invoices are missing information or don’t match a purchase order, they are flagged for review. AI simplifies this process by identifying patterns in these issues and routing the invoices to the appropriate approver based on past resolutions. This reduces delays and speeds up the process.

Once verified, invoices are routed according to rules like department, spending limits, or GL codes. AI streamlines this process by identifying the most likely approver, flagging potential delays, and predicting bottlenecks to ensure smooth operation.

Approved invoices are sent directly to your ERP, ready for payment on schedule. This helps avoid late fees, improves vendor relationships, and provides better control over your working capital.

AI-powered assistants improve every step

Artificial intelligence takes invoice approval beyond simple automation. It not only processes invoices but also learns, adapts, and improves results over time.

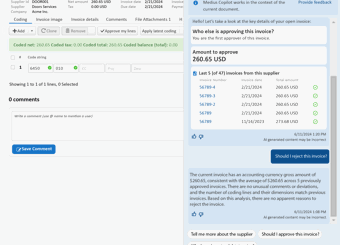

Medius Copilot, for example, is an AI workmate that:

- Suggests approvers based on historical behavior

- Recommends account codes from similar past invoices

- Flags missing or inconsistent data to resolve exceptions faster

- Escalates stalled approvals to keep workflows moving

- Translates invoices for multinational teams to eliminate language barriers

- Guides approvers conversationally by answering their questions in real time

With AI, invoice approvals are faster, more accurate, and less frustrating for everyone.

Why automate invoice approval?

Automation speeds up and streamlines the invoice approval process. With built-in AI, the system gets smarter over time. Here’s how this benefits your business:

Greater efficiency

AI streamlines every step, from capture and coding to routing and escalation, allowing your team to approve invoices faster and from anywhere.

Improved accuracy

AI recognizes patterns, improves coding, and minimizes matching errors. The more invoices you process, the better it gets.

Enhanced security

Digital approvals are encrypted, audit-ready, and controlled by secure permissions. AI also detects anomalies that may signal fraud or manipulation.

Lower costs

Automation reduces time spent chasing down approvals. When exceptions decrease and cycle times shorten, your cost per invoice declines.

Real-time visibility

Dashboards show approval status, processing bottlenecks, and KPIs. AI makes reporting smarter, surfacing trends and insights in real-time.

Stronger supplier relationships

Quick and reliable payments build trust with vendors and can lead to better terms. AI also enables automated responses to vendor questions, cutting down on unnecessary back-and-forth.

Improved compliance

Every step of the process is logged. AI helps enforce policies, flags violations and ensures audit trails are always intact.

Common invoice approval challenges

and how AI helps

Even with automation in place, invoice approvals can still encounter bottlenecks. Here are some common challenges and how AI improves them:

- Delayed approvals

When approvers are unavailable or unsure, AI helps by recommending the right person, sending reminders, and escalating issues when needed. - Incomplete data

AI flags missing information and suggests fixes, helping AP avoid invoice ping-pong between departments. - Language barriers

AI translates invoices in real time, allowing global teams to approve quickly with no bottlenecks from language issues. - Lack of visibility

AI-powered dashboards highlight trends, delays, and performance gaps so you can act faster. - Exception management

Instead of routing all exceptions manually, AI uses historical patterns to automatically resolve or direct them to the right person the first time.

How faster approvals improve

supplier relationships

Vendors want prompt, predictable payments. A smoother invoice approval process helps you deliver on that.

Faster approvals = faster payments

Speed builds trust. When invoices move quickly, you can pay on time or even early, earning goodwill and discounts.

Better communication

Real-time updates and alerts help AP teams answer vendor questions quickly and accurately. AI takes this further by predicting delays and supporting proactive communication.

Fewer errors

Automation helps prevent duplicate or incorrect payments, while AI adds an extra layer of oversight.

Stronger cash flow control

AI can recommend which invoices to prioritize based on trends, due dates, and payment terms, giving you more strategic control over your spend.

Easy audit prep

With every action logged and accessible, audits are easier, faster, and less stressful.

Frequently asked questions

The software captures and validates invoice data, applies business logic, and routes to the right approver. Once approved, it integrates with your ERP for payment.

Yes. Most modern tools offer pre-built integrations or APIs that enable seamless connection with major ERP platforms.

Yes. Invoice data is encrypted, stored securely, and access-controlled, far safer than paper-based approvals.

Yes, you can track and visualize AP metrics like cycle time, touchless rate, and error frequency on dashboards to improve performance.