AP automation & cybersecurity safeguards for sensitive financial data

- Introduction

- Why financial data is a prime target for cybercriminals

- The intersection of AP automation and cybersecurity

- Key cybersecurity threats AP teams face

- How AP automation strengthens cybersecurity

- Why cybersecurity is now a CFO responsibility

- The future of AP automation and cybersecurity

- Safeguard your AP workflows with Medius

Hear what's covered in this article:

As finance teams embrace automation to streamline accounts payable (AP) processes, the importance of cybersecurity has never been greater. As cyber threats become more frequent and complex, safeguarding sensitive financial data has become a top priority for CFOs and AP leaders alongside IT teams.

From business email compromise (BEC) scams to invoice fraud and data breaches, finance departments face mounting threats that can disrupt operations and compromise vendor trust. AP automation plays a central role in not only improving efficiency but also strengthening cybersecurity controls. When properly implemented, automated AP systems act as a digital shield—reducing exposure to risk and giving organizations real-time visibility into suspicious activity.

Why financial data is a prime target for cybercriminals

Accounts payable departments manage a constant flow of highly sensitive data—vendor bank account information, payment details, invoice records, and internal financial workflows. This makes AP systems an attractive target for cybercriminals looking to intercept funds or steal credentials.

Cyberattacks on finance functions have evolved from opportunistic to strategic. Sophisticated actors now use phishing, spoofed emails, and even deepfake technology to manipulate finance teams into making unauthorized payments or disclosing confidential information. Without the right defenses in place, a single compromised invoice or email can lead to massive financial and reputational damage.

The intersection of AP automation and cybersecurity

Modern AP automation replaces manual processes with intelligent, secure workflows by embedding cybersecurity protocols throughout the entire invoice to payment process. By digitizing approvals, enforcing authentication layers, and applying anomaly detection, AP teams gain more control over their payment environment and reduce their vulnerability to fraud.

Unlike traditional workflows, automated AP systems don't rely on human memory or manual review, which are prone to error. Instead, they build a reliable digital framework where every step is secured and every transaction can be verified.

AI-powered AP automation takes this one step further. These systems can learn from past transaction behavior, identify anomalies in real time, and flag suspicious activity before payments are released. This proactive approach gives finance teams a critical edge in the ongoing battle against cyber threats.

Key cybersecurity threats AP teams face

While the specific risks may vary, most AP departments face a similar set of cyber threats:

Business email compromise (BEC)

Fraudsters pose as executives or vendors to manipulate finance teams into sending unauthorized payments.

Invoice fraud

Malicious actors submit fake or altered invoices that appear legitimate, hoping to bypass manual reviews.

Account takeover

If login credentials are compromised, attackers may gain access to AP systems and reroute payments.

Data breaches

AP systems hold personally identifiable information (PII) and financial data, which can be leaked or sold on the dark web.

These threats underscore the importance of strengthening internal controls and adopting technologies that reduce human error and exposure.

How AP automation strengthens cybersecurity

The role of AP automation in cybersecurity is twofold: improving efficiency and minimizing risk. Automated platforms reduce manual touchpoints, introduce multi-level approvals, and maintain comprehensive audit trails—all of which support a secure financial environment.

- Authentication controls: Secure AP platforms enforce multi-factor authentication (MFA) and role-based access controls, ensuring that only authorized users can approve or initiate payments. This prevents unauthorized access and ensures that every user is accountable for their actions.

- Digital audit trails: Every action—invoice upload, approval, payment release—is logged automatically, enabling traceability and accountability for every transaction.

- Real-time monitoring: AI and machine learning continuously scan for unusual behavior, such as out-of-pattern payments, vendor detail changes, or duplicate invoices. Alerts are sent immediately, allowing finance teams to intervene before issues escalate.

- Vendor validation: Automated systems cross-reference vendor data with trusted sources to detect fake or altered account information before payments are processed. This minimizes the risk of payment diversion and ensures supplier legitimacy.

In short, automation serves as both a gatekeeper and a watchdog, monitoring for threats while ensuring financial operations stay aligned with strict protocols.

Why cybersecurity is now a CFO responsibility

Cybersecurity is no longer confined to the IT department. As financial fraud grows in sophistication, CFOs and finance leaders are under pressure to take an active role in protecting corporate assets.

This shift is partly driven by regulatory requirements. Data privacy laws such as GDPR, CCPA, and SOX place accountability for breaches directly on leadership. Additionally, auditors and board members increasingly expect finance teams to demonstrate risk mitigation efforts, both to meet compliance standards and to reflect operational maturity.

AP automation provides a clear path forward. By embedding security controls into core workflows, CFOs can meet regulatory expectations while also protecting the organization’s bottom line.

The future of AP automation and cybersecurity

As digital transformation accelerates, the relationship between AP automation and cybersecurity will only grow stronger. AI-powered systems are evolving to be predictive rather than reactive—flagging potential issues before they escalate and guiding finance teams toward safer, smarter decision-making. For organizations aiming to modernize their AP function, the goal has shifted from simply accelerating invoice processing to ensuring complete protection across all financial operations.

Safeguard your AP workflows with Medius

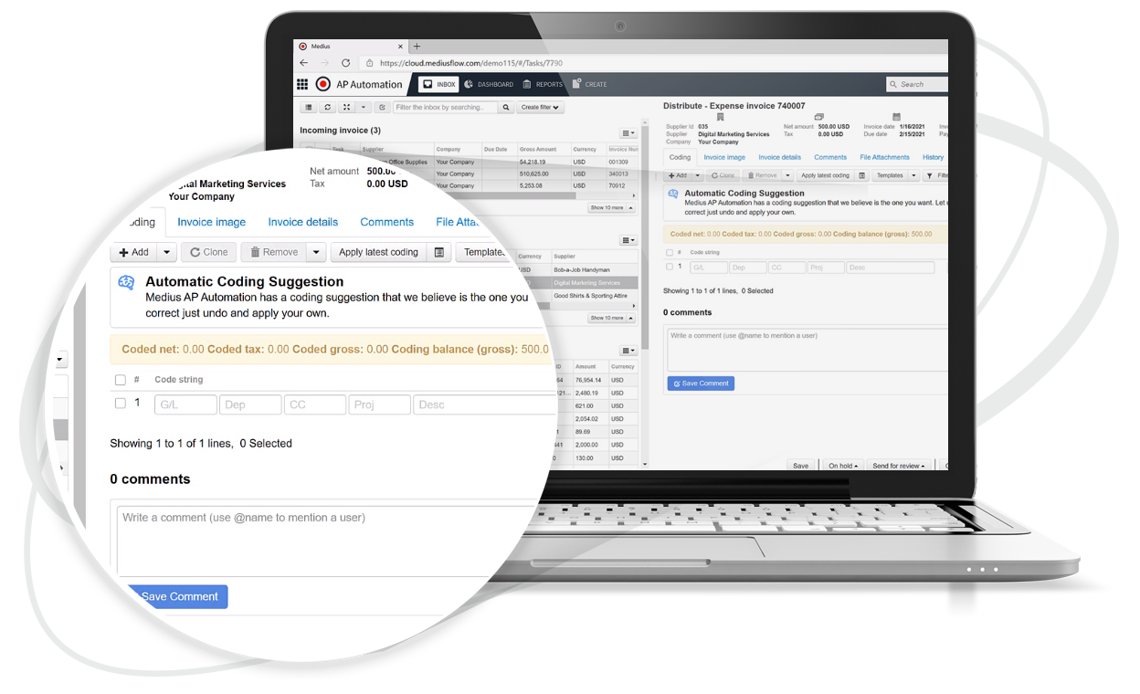

As cyber threats grow more sophisticated, Medius delivers the security-first AP automation you need to stay protected. From AI-driven fraud detection to secure invoice processing, our platform empowers finance teams to reduce risk and take control of sensitive financial data with confidence.

Explore our AP automation, fraud & risk detection, and compliance solutions to see how Medius helps businesses safeguard operations while streamlining workflows.

Book a demo today and discover how Medius can fortify your AP processes while accelerating digital transformation.