The most common problems in accounts payable & their solutions

Hear what's covered in this article:

Accounts Payable (AP) operations form the backbone of a company's financial health. Efficient AP processes are essential for maintaining positive cash flow, vendor relationships, and compliance adherence. Without strategic solutions in place for common AP problems, businesses risk monetary losses, legal issues, strained supplier ties, and reputational damage - ultimately hindering growth and sustainability. As finance teams face greater complexity in a globalized economy, challenges like cross-border payments, tax regulation shifts, and fraud threats further compound these risks.

As the business landscape progresses, technology integration and process automation provide pathways for organizations to optimize AP.

Automating accounts payable unlocks game-changing potential for organizations in three key dimensions:

Financial optimization

Improving working capital and cash availability through enhanced visibility, control, and predictive analytics based on interconnected digital platforms.

Risk mitigation

Reducing compliance infractions, strengthening fraud protections, and minimizing audit vulnerabilities enabled by artificial intelligence capabilities.

Growth enablement

Scaling operations efficiently while freeing up capacity for value-added initiatives through process automation and exception-based workflows.

This comprehensive guide examines pressing challenges within accounts payable, analyzing the intricacies of each problem and providing educated professionals an in-depth look at constructive solutions. The AP Automation experts at Medius have outlined ten of the most common problems faced by accounts payable teams today.

By examining some of the most common accounts payable challenges, this guide provides business leaders an in-depth look at constructive solutions ready for implementation. Let's dive in.

Invoice processing delays

PROBLEM

The timely processing of supplier invoices remains a prevalent struggle across industries, largely stemming from manual procedures like paper bills and spreadsheet logging. These antiquated systems harbor inefficiency, heightening the risk of misplaced documents, data entry errors, overlooked discounts, and convoluted approval chains. The resulting delays disrupts cash flow, inflates AP costs through late fees, and strains vendor relationships - especially with small to medium suppliers relying on prompt payments. Even as digital payments become more common, many businesses still rely on mailed checks—slower, costlier, and more prone to fraud. The inertia of legacy systems also hinders the agility required to capitalize on market shifts.

SOLUTION

Digital automation introduces advanced technologies like artificial intelligence, machine learning algorithms, and optical character recognition (OCR) that extract invoice data instantly without manual intervention - slashing processing times from weeks to days or hours. Integrating workflow automation and rule-based routing further expedites processing by auto-sending invoices to approvers based on customized business logic. Three-way matching capabilities automatically compare invoices with purchase orders and receipts to catch discrepancies early and reduce the need for manual validation. With real-time tracking and status notifications, financial leaders can also actively monitor invoices, verify discounts, and intervene on exceptions. This creates organizational accountability while allowing staff to focus on value-added activities.

Compliance issues

PROBLEM

Adhering to evolving tax codes, privacy statutes, and industry regulations presents a formidable challenge in accounts payable. Non-compliance risks hefty fines alongside diminished public trust and legal reprimands. Yet pinpointing every change across multiple jurisdictions proves incredibly difficult, especially with decentralized teams and infinitesimal policy updates. Globalization and cross-border transactions add another layer of complexity, introducing region-specific e‑invoicing rules, VAT mandates, and real-time reporting requirements that many AP teams still track manually. This complexity, paired with humans manually reviewing each transaction, opens the door for unintended errors despite best intentions.

SOLUTION

Automation technology enables organizations to embed compliance directly into accounts payable systems. Purpose-built software centralizes rules and restrictions across all locations into a singular platform with automatic notifications on legislated changes. Invoice validation protocols then screen documents, vendor master files, and payments against configured watch lists and forbidden transaction filters, rejecting non-compliant submissions for rapid remediation. Modern platforms like Medius can automatically apply country-specific tax rules, format invoices to meet local XML or e‑invoicing standards, and timestamp submissions for audit purposes. Compliance modules also auto-adjust tax calculations whenever rates get updated. These tools integrate compliance efforts across finance departments for consistent, auditable enforcement powered by technology.

Fraud risks

PROBLEM

Both internal fraud from employees and external schemes by hackers present growing threats as financial transactions expand across borders and online channels. Common techniques like duplicate invoices, vendor impersonation, and payment manipulation bypass traditional defenses in purely manual processes. Check fraud and business email compromise (BEC) scams are also increasingly common, targeting AP teams with convincing fake requests for payment. And without robust oversight, small deceptions easily evade detection only to recur frequently - generating huge cumulative impacts. Fraud prevention therefore hinges on early anomaly detection and rapid response systems before problems spiral out of control.

SOLUTION

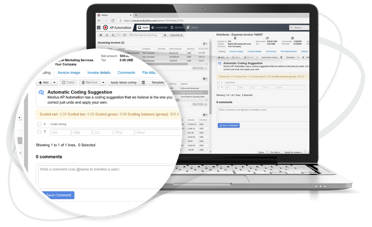

Automation again strengthens fraud protection through both prevention and early detection. Configuring user access restrictions, multi-factor logins, and role-based permissions limits access to sensitive financial data, reducing inside threat vectors. AI-powered AP systems add another layer of protection by analyzing invoice data in real time, flagging anomalies, scoring payment risk, and detecting duplicate or suspicious transactions. External risks decrease through AI algorithms that screen invoices against past records to systematically identify duplicates plus computer vision capable of spotting even slightly modified documents. Activity monitoring and real-time alerts on suspicious transactions also enable investigation of potential fraud before payments processes to minimize financial exposure. Together these tools create an integrated shield against internal and external fraud.

One mistake can cost millions.

Can your business afford that?

A manual AP process is a fraud risk waiting to happen. Without proactive controls, bad actors exploit weak spots in invoice and payment workflows, putting your business and reputation on the line. The “AP Fraud Fighters Toolkit” gives you the strategies to detect threats early and protect your bottom line.

Data inaccuracies

PROBLEM

Inaccurate data plagues manual accounting operations, sowing distrust in financial reporting and analytics used to guide strategic decisions. Typos, misinterpretations, and reporting errors easily slip in when teams rely on paper bills, email reminders, and spreadsheet tracking. Without connected systems, discrepancies cascade across teams - resulting in incorrect payments or penalties from inaccurate tax filings. And without data validation, these problems remain invisible to decision-makers.

SOLUTION

Intelligent automation introduces digital connectivity and embedded data verification to extract, enrich, and reconcile financial transactions with minimal manual work. AI-powered tools, including optical character recognition, pull key invoice data upon delivery which automated workflows then validate against purchase orders and product delivery receipts prior to payment. Machine learning algorithm, handles queries while machine learning algorithms pull supplier and product details from enterprise resource planning systems to enrich transactional metadata for deeper insights. Integrated ERP and AP automation platforms also eliminate redundant data entry and synchronize changes instantly, improving both accuracy and reporting speed. These features not only bolster data integrity but also improve reporting to drive better supplier agreements and capital investments grounded in trusted analytics.

Vendor management challenges

PROBLEM

Complex vendor landscapes increase accounts payable risks due to off-cycle payment requests, urgent supplier invoices, and dispute resolution needs. Missing contract renewal dates or suddenly prioritizing one vendor then cascades across other partners through delayed payments plus weakens negotiating power on new terms. Accounting teams therefore juggle myriad supplier relationships and requests simultaneously while strategically guiding vendor code consolidation to maximize economies of scale - an impossible task without technology enhancement.

SOLUTION

Automation empowers enterprises to actively manage vendor master data rather than passively react to supplier requests. Integrated dashboards spotlight vendors nearing contract expirations for timely renegotiations while machine learning recommendation engines suggest merging supplier codes based on pricing and category synergies. Vendor portals also enable self-service invoice submissions and onboarding documentation uploads to offload repetitive administrative work from accounting departments. Lastly "auto-pay" rules route validated invoices directly through payment processing while still diverting non-PO and early payment discount invoices for manual prioritization. Together these capabilities tighten vendor partnerships to deliver mutually beneficial contract value.

Lack of visibility & control

PROBLEM

Accounts payable decisions often rely on instinct rather than data insights when using disjointed accounting systems. Siloed legacy platforms obscure visibility across the procure-to-pay process through paper-driven updates and isolated data sets. This fragmentation restricts leaders' ability to pinpoint invoice bottlenecks, predict future cash obligations, and adjust policies to exercise greater financial control. The resulting uncertainty erodes CFO confidence to pursue bold or innovative business strategies. This lack of visibility makes it difficult to identify duplicate payments, missed early payment discounts, or potential fraud risks, all of which require real-time insights to address effectively.

SOLUTION

Connected digital platforms centralize activities into fluid procure-to-pay workflows with drill-down analytics on all transactions. Intuitive dashboards enable executives to actively monitor average invoice processing times, cash availability, and early payment discounts captured - not waiting until month-end for static summaries. Role-based access controls, audit trails, and real-time reporting tools give finance teams full transparency into AP activity and approval chains. Similarly automated notifications alert managers to invoices nearing due dates or new vendor submissions to drive accountability. Armed with a holistic system perspective, finance chiefs can strategically optimize dynamic discounting programs, payments schedules, and supplier contract terms for total control.

High operational costs

PROBLEM

Labor-intensive manual processes burden accounts payable teams with repetitive administrative tasks that inflate headcount costs and divert focus from value-adding initiatives. Staff get mired in filing paperwork, keying data, and answering supplier status inquiries as transaction volume climbs year-over-year. Offboarding and retraining replacement workers whenever talented employees inevitably burn out further concentrates institutional knowledge into fewer individuals while allowing errors to resurface.

SOLUTION

Automation reduces the mundane manual work associated with transaction processing so staff shift towards oversight roles rather than operative functions. Auto-categorizing invoices based on past data then allows clerks to manage by exception instead of entering every bill. External vendor portals also field status inquiries and documentation needs directly from suppliers, preventing interruptions to worker productivity. As the technology assumes the manual labor, departments gain capacity to onboard new vendors, renegotiate contracts, and pursue process excellence without added staff - achieving more with less.

Difficulty adapting to growth

PROBLEM

Attempting to scale accounts payable functions using legacy approaches strains resources and risks introducing errors into the finances of growing organizations. CFOs typically resort to just hiring more people as transaction volumes climb each year – but maintain the same paper files, email follow-ups, and shared network drives. Eventually expanding headcount becomes financially unviable, especially as seasoned employees continually train the new staff. And the increased data overwhelms spreadsheet tracking.

SOLUTION

Cloud-based automation provides on-demand scalability to organizations by allowing them to handle increased workloads without making equivalent investments in personnel or technology infrastructure. The software-as-a-service model also lets organizations pay only for the computing resources used rather than purchasing assets upfront that could remain underutilized. This maximizes economies of scale from growth by keeping marginal human resource costs near zero and delivering flexibility to scale down just as quickly.

Cross-border payment complexities

PROBLEM

As companies expand into global markets, accounts payable teams must navigate a growing web of international banking rules, currencies, and tax structures. Without the right infrastructure, cross-border payments can lead to delayed transactions, incorrect currency conversions, duplicate invoices, or compliance violations in different regions. These challenges increase operational friction and put supplier relationships at risk, especially when local expectations for payment timing or documentation aren’t met.

SOLUTION

AP automation platforms like Medius help streamline cross-border payments by automating currency handling, applying region-specific tax rules, and ensuring invoices meet local formatting and compliance standards. This reduces manual intervention and mitigates the risk of errors, delays, or non-compliance. With centralized control and real-time tracking, finance teams gain visibility into international payables and can better manage global cash flow. This consistency enables stronger vendor relationships and improved financial forecasting across markets.

Want to future-proof your global

AP strategy?

Download our Global Payments Guide to learn how automation can simplify international payments, reduce risk, and support scalable finance operations worldwide.

Audit & reporting weaknesses

PROBLEM

Piecing together system reports, paper records, reconciliation sheets, and staff recollections to support internal audits or external reporting adds little strategic value while pulling financial analysts from key business partnering roles. Different file access permissions across legacy accounting platforms also complicates confirming balances and previous reporting. Documenting corrective actions then involves circulating emails and status spreadsheets prone to version control issues.

SOLUTION

An integrated automation suite centralizes transactions, process data, and reports into a unified analytics hub for seamless auditing and compliance documentation. Role-based access allows managers to run and distribute real-time reports independently without creating fresh requests. Tracking logs with timestamps across the platform also simplify proving when transactions occurred or changes deployed for accurate external reporting. Lastly automated workflow steps, pre-configured alerts, and AI chatbots ensure organizations act rapidly to address gaps uncovered during reviews.

Paper waste environmental impacts

PROBLEM

Despite sustainability gains across enterprises, most accounts payable departments still rely on traditional paper-driven practices that carry negative environmental footprints. Extensive printing, copying, and filing of invoices, purchase orders, disputes, and other financial documents generate huge volumes of paper waste alongside resource-intensive storage needs. Off-site records retention and shredding services further compound environmental impacts over time.

SOLUTION

Shifting documentation to digital formats significantly reduces paper usage through electronic storage and approvals workflows. This "paperless office" model pioneered by automated solutions minimizes printing to only final remittance copies. Fewer physical documents also decreases electricity demands from servers, data facilities, and office equipment plus enables greater adoption of eco-friendly business practices. As climate change concerns capture larger mindshare, finance leaders can leverage automation to deliver sustainability benefits spanning reduced waste, energy use, and carbon emissions.

Current accounts payable procedures face pressing technology and process limitations that introduce business risks, hinders productivity, and decreases sustainability. Finance executives now recognize the extensive drawbacks of manual legacy systems in today's high-velocity markets. By pursuing comprehensive automation, enterprises gain an integrated suite of tools to boost compliance, tighten fraud prevention, maximize working capital, streamline vendor relationships, and support strategic growth - all while reducing environmental footprints through paperless processing. As the solutions outlined above illustrate, financial leaders have an unprecedented opportunity to transition their accounts payable functions into a strategic asset accelerating corporate success.

Don’t let outdated AP processes hold your business back. Medius delivers AI-powered accounts payable solutions and consulting expertise to help finance teams automate workflows, improve accuracy, and gain real-time visibility. By partnering with Medius, you can optimize invoice processing, enhance compliance, control spend, and unlock the full strategic value of AP.

Ready to modernize your AP function?

Contact Medius today to schedule a consultation.

Frequently Asked Questions (FAQ)

The most common AP issues include invoice processing delays, duplicate payments, compliance risks, fraud, data entry errors, and a lack of visibility across workflows.

AP automation eliminates data entry, routes invoices for approval automatically, matches documents using AI, and provides real-time status updates, all of which reduce manual workload.

Duplicate payments are often caused by manual data entry, unclean vendor master records, or invoices submitted through multiple channels without validation.

Modern AP systems use fraud detection tools like vendor bank validation, multi-factor authentication, and invoice risk scoring to catch suspicious activity before payments are made.

Three-way matching compares invoices, purchase orders, and delivery receipts to verify accuracy before payment, helping reduce errors and fraud.

Using a centralized, cloud-based AP system with dashboards, audit trails, and real-time analytics improves visibility and control over the full invoice lifecycle.

Early payment discounts are incentives vendors offer for faster payment. AP automation helps by processing invoices quickly and flagging discount opportunities before deadlines.

They use AP platforms that support multi-currency payments, local tax compliance, and region-specific e-invoicing standards to streamline international operations.