Spend Management vs Expense Management: What is the Difference?

In the intricate world of financial management, terms like "spend management" and "expense management" often get used interchangeably. However, while they might seem synonymous, they serve distinct purposes in the business landscape. This article aims to delineate the differences and showcase the importance of both in the realm of AP automation. As businesses grow and evolve, understanding these nuances becomes essential for effective financial management.

What is spend management?

Spend management is the holistic approach to managing, controlling, and optimizing company-wide expenditures. It's a strategic method that goes beyond just tracking costs. This includes everything from procurement and supplier management to contract management. Effective spend management can lead to improved supplier relationships, better contract terms, and significant cost savings.

What is expense management?

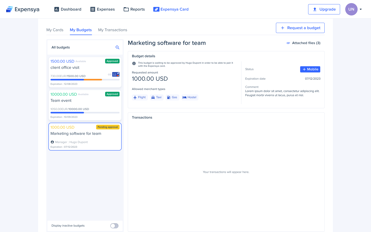

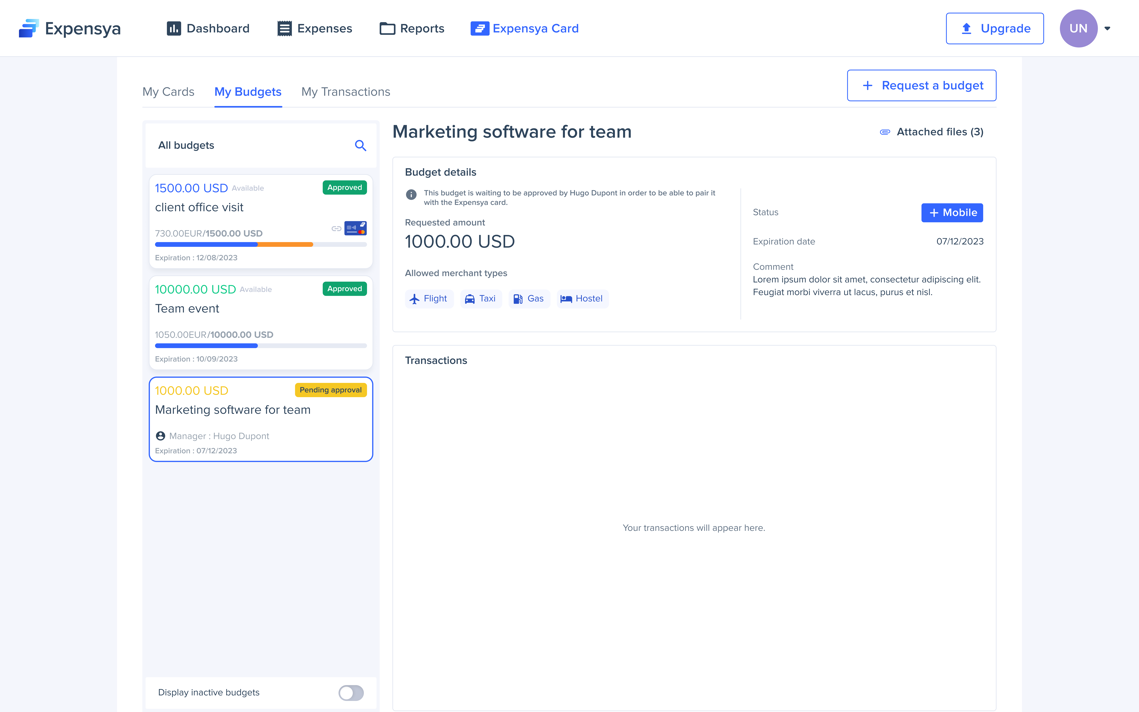

Expense management, on the other hand, is more employee-centric. It focuses specifically on tracking, processing, and reimbursing business expenses incurred by employees. This could be anything from travel expenses to office supplies. Proper expense management ensures that employees are reimbursed promptly and accurately, fostering trust and reducing financial discrepancies.

Key differences between spend management and expense management.

While spend management takes a bird's-eye view, looking at all company expenditures, expense management zeroes in on specific reimbursable business expenses. The former is about optimizing the entire spending process, while the latter ensures individual expenses align with company policies.

Spend management involves a broader range of processes, including procurement, supplier negotiations, and contract management. Expense management, meanwhile, revolves around receipt tracking, policy enforcement, and reimbursements. It's about ensuring that the reimbursement process is smooth, transparent, and efficient.

Different departments and teams handle these two areas. Procurement teams and finance departments often handle spend management. In contrast, HR, individual employees, and sometimes even travel departments might be more involved in expense management.

While they serve different purposes, spend and expense management often intersect. An integrated approach ensures that they complement each other. For instance, a purchase made through spend management might later be processed as an expense for an employee. This overlap highlights the importance of having systems that can handle both aspects seamlessly. Integrated systems, ensure comprehensive financial management, providing businesses with the tools they need to manage both effectively, without any data discrepancies.

The role of AP Automation in spend and expense management.

Streamlining processes

Streamlining processes

AP automation is a game-changer for both spend and expense management. By reducing manual tasks, it ensures accuracy, saves time, and reduces the risk of fraud. Automated systems can process vast amounts of data quickly, ensuring that both spend and expenses are tracked and managed efficiently.

Data analytics & insights

Data analytics & insights

AP automation tools often come with robust analytics capabilities. These tools provide businesses with insights into their spending patterns, helping them identify areas for cost savings, better supplier negotiations, and more effective budgeting.

Integration benefits

Integration benefits

The integration benefits of AP automation are manifold. An integrated system handles both spend and expense management. This ensures consistency, compliance, and efficiency, allowing for a unified view of all financial data.

The crucial role of spend and expense management.

Understanding the distinctions between spend management and expense management is crucial for businesses aiming for financial optimization. Both play vital roles in ensuring a company's financial health. With the advancements in AP automation, managing both has never been easier. Dive deeper into the world of spend management with Medius' comprehensive guide.