How to prevent duplicate payments in accounts payable

Duplicate payments in accounts payable are a significant concern that can adversely affect a company's financial health. For Accounts Payable (AP) managers, ensuring the accuracy and efficiency of financial transactions is a top priority. Tackling this issue head-on requires a thorough understanding of its causes and impacts.

This article sheds light on the problem of duplicate payments in AP, examining its root causes and consequences. It also explores how the strategic application of AP automation solutions, like those offered by Medius, can effectively mitigate and prevent these costly errors.

Let's first examine how widespread and impactful duplicate payments are.

The prevalence and impact of duplicate payments

Duplicate payments in accounts payable, though often overlooked, can significantly strain a company's financial resources. Their prevalence is a concern even for the most vigilant AP departments, as they can arise from a variety of operational inefficiencies.

Impact on the bottom line

Duplicate payments lead to unnecessary financial outflows, draining resources that could be better utilized elsewhere within the company. The cost implications extend beyond the immediate financial loss, encompassing the time and effort required to identify and rectify these errors.

Operational efficiency and compliance risks

Frequent occurrences of duplicate payments can also impact supplier relationships and tarnish a company's reputation in financial management. Moreover, they may indicate weaknesses in internal controls, increasing compliance risks and highlighting areas in need of more robust financial management practices.

How AP automation combats duplicate payments

The adoption of Accounts Payable (AP) automation marks a significant shift in how organizations tackle the issue of duplicate payments. By harnessing the power of technology, businesses can markedly reduce the occurrence of these costly errors.

Automating for accuracy and efficiency

AP automation streamlines invoice processing. From data entry to payment, automation reduces the reliance on manual processes, which are often the culprits behind duplicate payments. By automating these tasks, companies can achieve a higher level of accuracy and consistency in their financial transactions.

Enhanced visibility and control

One of the key benefits of AP automation is the increased visibility it offers into the entire accounts payable process. This visibility is crucial in identifying and preventing duplicate payments. With real-time tracking and reporting features, AP managers gain a comprehensive view of all transactions, enabling better oversight and control.

Proactive error detection

Advanced AP automation systems are equipped with tools to proactively identify potential errors before they become issues. These systems can flag duplicate invoices and alert the relevant personnel, allowing for timely intervention and correction.

AP automation's role in mitigating the risk of duplicate payments is undeniable. By embracing these technological solutions, businesses can not only prevent financial losses but also enhance their overall accounts payable efficiency.

6 features of Medius software that combat duplicate payments

While AP automation broadly offers a path to mitigating the risks associated with duplicate payments, it's the specific features of such systems that truly make the difference. Medius software stands out in this regard, offering a suite of tools finely tuned to address the intricacies of duplicate payment prevention.

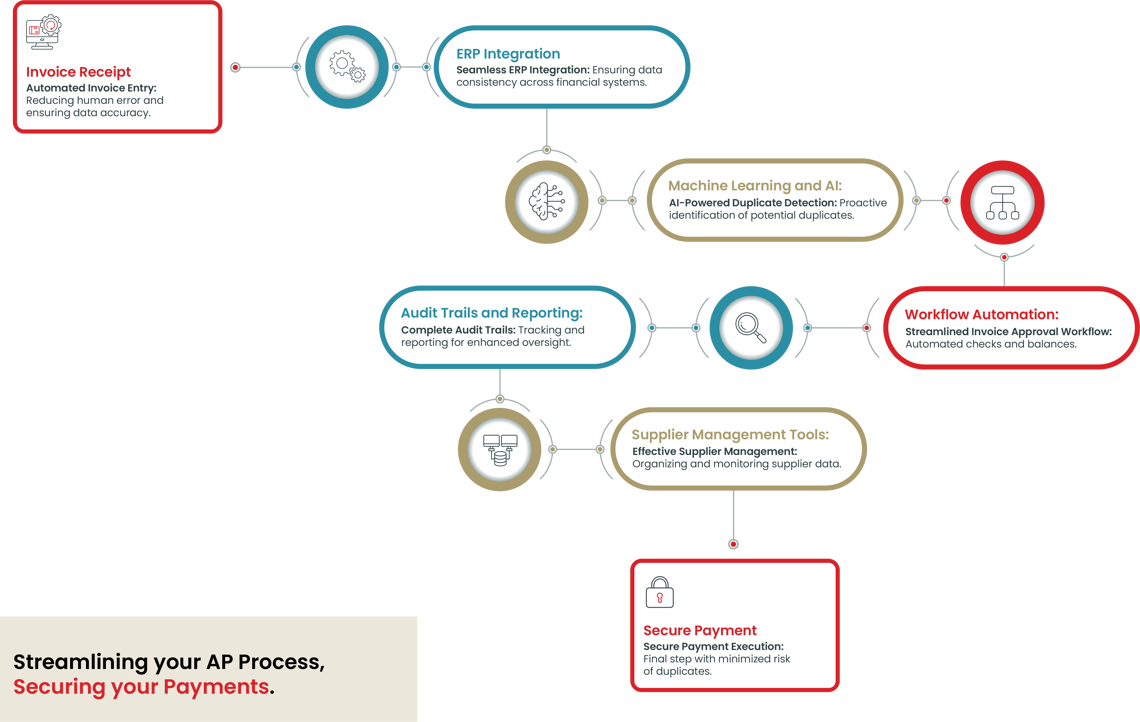

Automated invoice processing is the cornerstone of Medius’s approach to preventing duplicate payments lies in its robust invoice processing capabilities. By automating the entry and matching of invoice data, Medius reduces the potential for human error, a common source of duplicate payments.

Seamless integration with existing ERP systems is critical. Medius ensures that financial data flows accurately across systems, preventing discrepancies that can lead to duplicate payments.

These advanced technologies play a pivotal role in Medius’s software. They not only identify potential duplicate invoices but also learn from transaction patterns to continuously improve detection and prevention mechanisms.

Medius streamlines the entire invoice processing workflow. This automation ensures each invoice undergoes the necessary checks and approvals, significantly reducing the chance of duplicates slipping through.

With comprehensive audit trails and reporting capabilities, Medius offers AP managers complete visibility into the transaction lifecycle, making it easier to spot and rectify any occurrences of duplicate payments.

Effective management of supplier information is another key aspect. Medius’s tools help in organizing and tracking supplier data, further safeguarding against duplicate payment issues.

These features collectively create a robust defense against duplicate payments, transforming how businesses handle their accounts payable processes.

Here's a visual representation of how to navigate through duplicate payment prevention with Medius.

Best practices for AP managers beyond software

While the features of Medius software provide a strong foundation for preventing duplicate payments, AP managers can also adopt additional best practices to further safeguard their processes. These practices complement the technological solutions and offer a holistic approach to tackling duplicate payments and other challenges AP managers often face.

- Regular reconciliation procedures

Implementing regular reconciliation processes is vital. AP managers should routinely compare invoices with purchase orders and delivery receipts to catch duplicates early. - Supplier communication and management

Regular communication with suppliers about invoice processes and expectations can prevent errors. Establishing clear guidelines for invoice submissions and maintaining updated supplier information are key. - Employee training and awareness

Ensuring that the AP team is well-trained and aware of the common causes of duplicate payments is crucial. Regular training sessions can help staff identify and prevent potential issues before they escalate. - Internal controls and authorization protocols

Strong internal controls, including setting up appropriate authorization protocols for invoice approvals, play a significant role in preventing duplicate payments. - Regular audits and process reviews

Conducting audits and reviewing AP processes regularly can help identify systemic issues that might lead to duplicate payments, allowing for timely corrective actions. - Leveraging data analytics

Utilizing data analytics to monitor and analyze AP processes can uncover patterns that lead to duplicate payments, enabling proactive prevention strategies.

By integrating these best practices with advanced software solutions like Medius, AP managers can create a comprehensive defense against the risks of duplicate payments.

Key takeaways on eliminating duplicate payments

The challenge of duplicate payments in accounts payable extends beyond a simple operational error, significantly affecting the financial health and efficiency of businesses. However, with the integration of appropriate tools and practices, this issue can be effectively managed and mitigated.

Medius software stands as a crucial tool in this effort, offering innovative features specifically designed to prevent duplicate payments. From its automated invoice processing to AI-driven error detection capabilities, Medius equips AP managers with the necessary technology to protect their processes against these errors.

When combined with strategic best practices such as regular reconciliation, robust internal controls, and ongoing staff training, AP managers can establish a comprehensive system. This system not only prevents duplicate payments but also enhances the overall financial management of the organization.

In essence, preventing duplicate payments in accounts payable is about embracing technology within a broader strategy that includes effective management practices, continuous monitoring, and a dedication to operational excellence.

Elevate your AP operations with Medius: Streamline, secure, and succeed

As you address the intricacies of accounts payable, consider the transformative impact of Medius on your financial management approach. Our suite of AP automation tools is specifically designed to tackle challenges such as duplicate payments. Discover how Medius can streamline your financial operations and safeguard your company’s resources.