Why CFOs need integrated accounts payable and procurement in 2026

As CFOs face the dual demands of digital transformation and financial resilience, the spotlight is shifting toward how core finance systems interact. Nowhere is this more apparent than in the relationship between accounts payable (AP) and procurement. When these functions operate in isolation, inefficiencies multiply, maverick spend goes unchecked, supplier collaboration suffers, and financial planning becomes reactive rather than strategic.

The good news? This gap is fixable. Leading finance organizations are building unified

procure-to-pay platforms that integrate AP and procurement workflows to improve cash visibility, support compliance, and gain control over spend before it happens.

This blog takes an AP-first approach to explore why integration matters, what benefits it brings, and how Medius helps CFOs create smarter, more resilient finance operations.

How an integrated approach supports strategic finance goals

When AP and procurement are connected, the benefits span far beyond efficiency. Unified data and workflows directly support CFO priorities like working capital optimization, spend control, and risk reduction.

Integration allows finance teams to track spend commitments in real time, rather than waiting until an invoice arrives. This forward-looking visibility improves cash flow forecasting and helps prioritize payments based on actual need, contract terms, or early payment opportunities.

It also gives CFOs a clear view of liabilities before they hit the balance sheet, helping align financial planning with real-world activity. Having accurate insights into anticipated outflows empowers CFOs to make informed decisions quickly, even during periods of economic uncertainty.

One of the major risks of disconnected systems is inconsistent data and poor document control. When invoices and purchase orders live in separate platforms, validating spend becomes tedious and error-prone.

Integrated platforms enforce standardized workflows, making it easier to follow approval policies, detect policy breaches, and generate reliable audit trails. Medius supports compliance with region-specific tax regulations and financial standards, helping finance teams reduce manual intervention and maintain audit readiness across global operations.

This integration minimizes the burden during audit periods by ensuring that documentation is always available, approvals are clearly recorded, and compliance thresholds are maintained throughout.

Stronger controls start before the invoice is paid

When AP and procurement work in sync, compliance becomes proactive, not reactive. This report shows how modern finance leaders strengthen controls, improve audit readiness, and reduce risk by embedding automation across the full source-to-pay process.

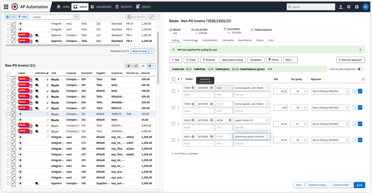

Connecting procurement data directly to AP reduces the risk of missing or mismatched POs. With purchase order and invoice data aligned from the start, match rates increase and exceptions decline, meaning less triage work and faster cycle times.

AP teams no longer waste time chasing down approvals or correcting basic errors. Instead, they can focus on value-added tasks like vendor analysis or forecasting accuracy. As first-pass success improves, so does the overall efficiency and confidence in financial data.

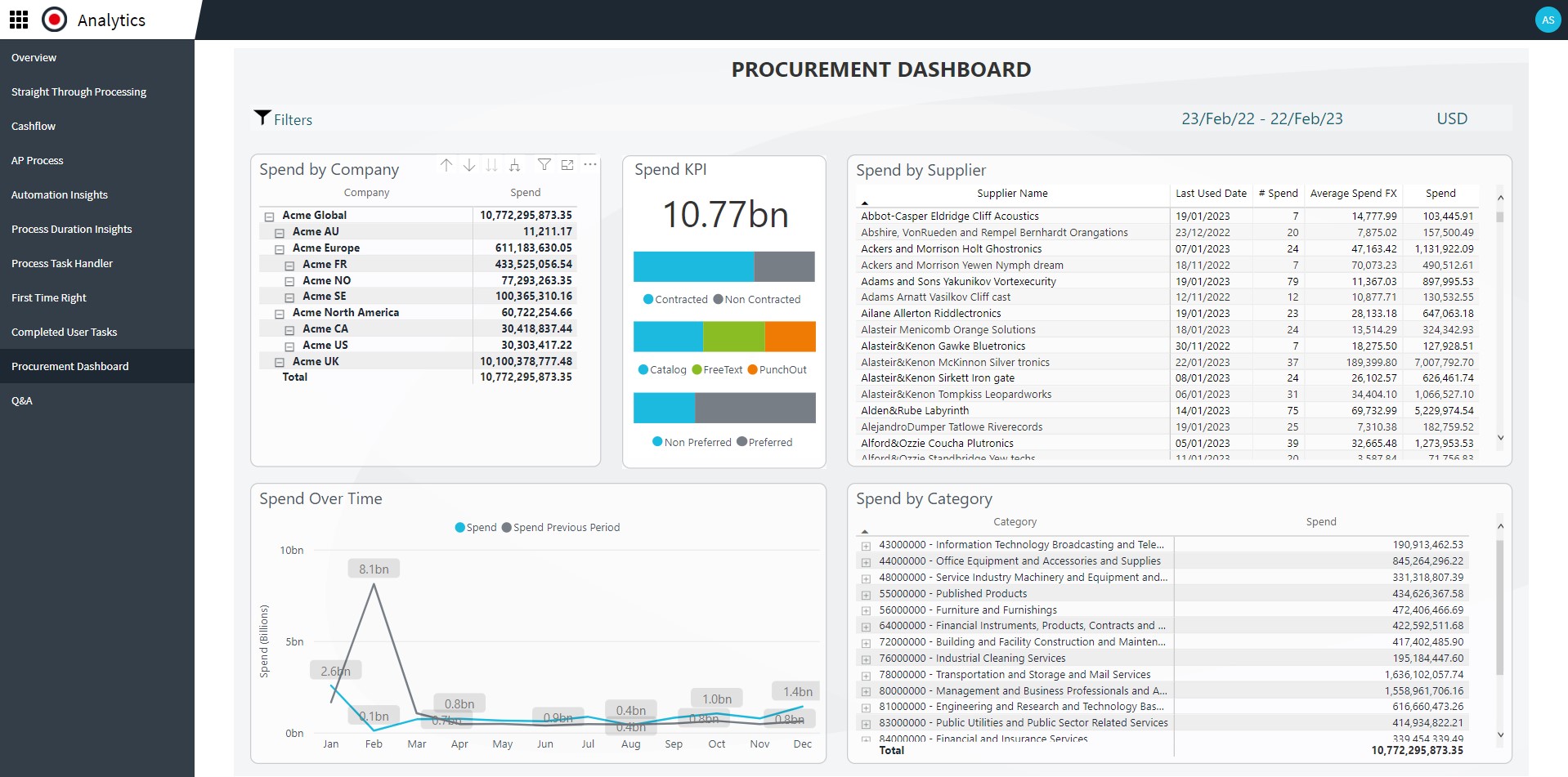

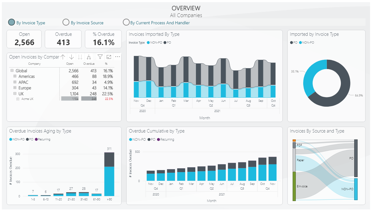

When procurement and AP data sit in the same system, finance teams gain a 360-degree view of spend, suppliers, and performance trends. This unified dataset fuels more accurate forecasting and long-term planning.

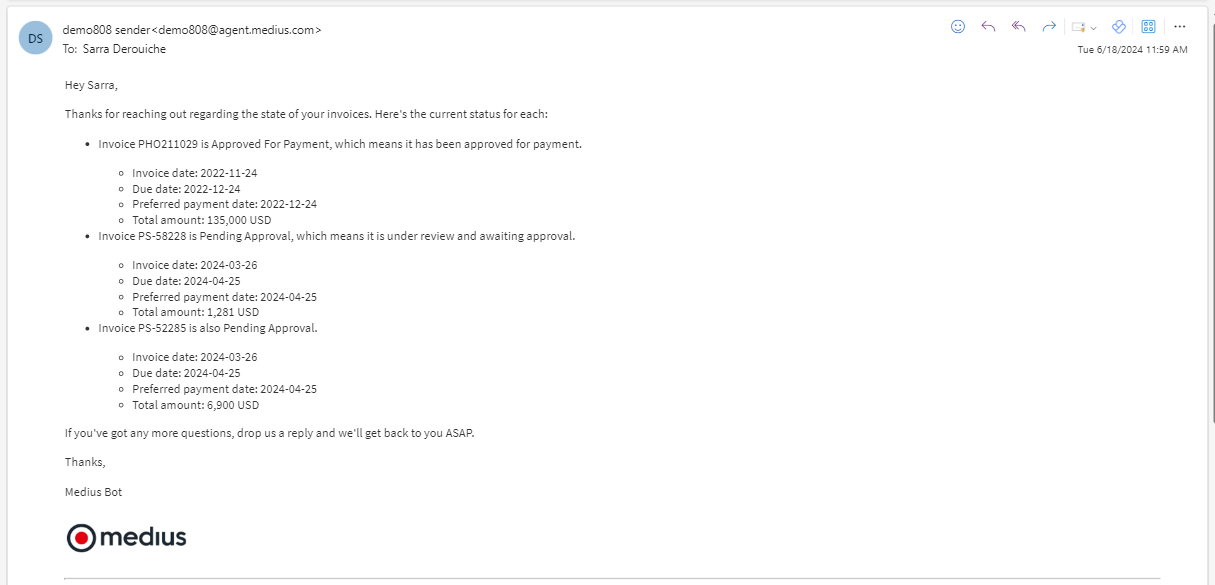

Medius Analytics brings these insights to life with real-time dashboards and predictive capabilities that help CFOs understand not only what was spent, but what will be spent, and where efficiencies can be gained.

With better forecasting, finance leaders can proactively manage working capital, identify risks earlier, and support executive decision-making with data-backed insights.

What to look for in a unified AP

and procurement platform

For CFOs planning digital transformation in 2026, not all integration strategies are equal. Success depends on choosing technology that can support AP-first needs while also enhancing procurement workflows.

Key capabilities to prioritize:

Native AP functionality

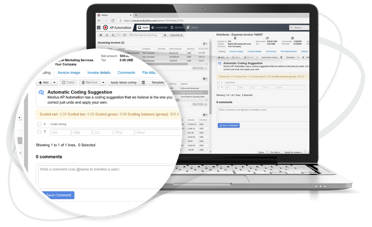

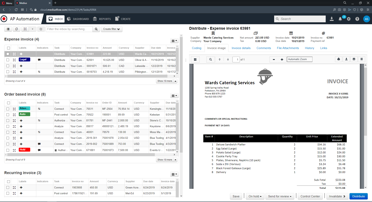

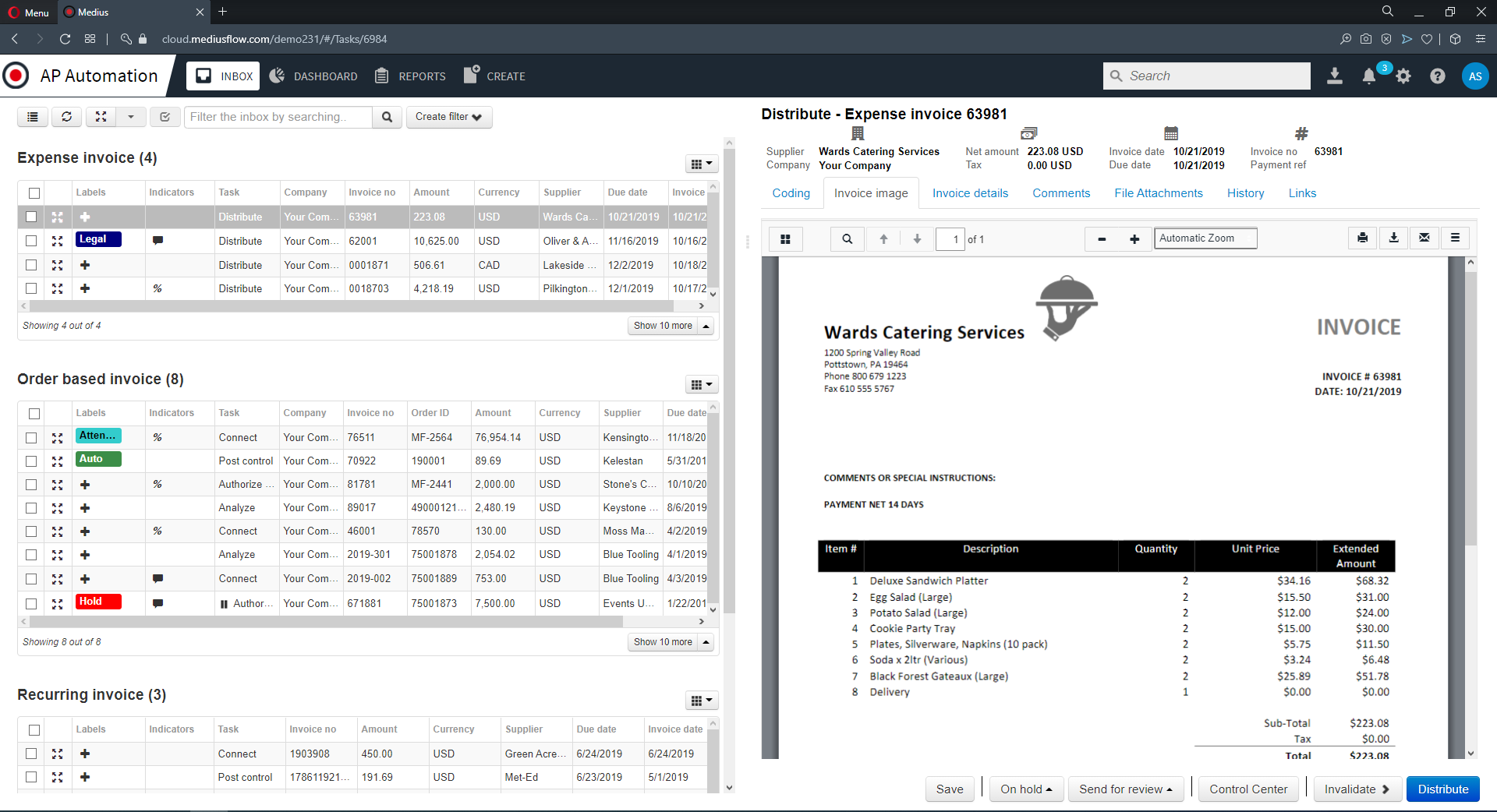

Ensure the platform supports full invoice lifecycle management including AP automation, approval routing, exception handling, and payment scheduling.

PO-to-invoice matching

Automated two- or three-way invoice matching ensures only approved spend is paid and removes the need for manual reconciliation.

Supplier collaboration tools

Look for features that simplify onboarding, track performance, and streamline communication throughout the supplier relationship.

Integrated compliance support

Choose a solution that helps enforce internal policies and external regulatory requirements without relying on custom workarounds.

Scalable analytics

Data should flow seamlessly from procurement to AP and into reporting tools that support real-time decision-making.

Medius meets these requirements with a modular platform that enables full procure-to-pay visibility without sacrificing control. Each solution works individually, but connects natively for finance-wide transformation.

Set for success with an AP-first platform that scales

Choosing a unified AP and procurement solution starts with getting AP right. This enterprise buyer’s guide outlines the capabilities finance leaders should prioritize to support compliance, visibility, and control, while laying the groundwork for a broader source-to-pay strategy.

Making integration a priority in your 2026 roadmap

Economic conditions remain uncertain, and finance leaders are expected to do more with less. Integrating AP and procurement is one of the most effective ways to create stability and scalability in how money is spent and tracked across the enterprise.

Instead of chasing approvals, investigating errors, or managing duplicate platforms, your team can spend more time optimizing spend, managing supplier risk, and driving cash flow strategy. The gains are both tactical and strategic.

By unifying accounts payable and procurement with automation, CFOs gain:

Clearer visibility into spend pipelines

Higher compliance and audit readiness

Faster invoice processing and payment cycles

Better decision-making supported by real-time data

This is far more than just efficiency gains. It is about unlocking the insights and control that finance leaders need to steer the business forward. The ability to see, control, and optimize spend in one platform is becoming the new standard for finance excellence.

Build your finance future with Medius

If you are planning digital transformation in 2026, it is time to unify your AP and procurement workflows into a single source of financial truth. Medius offers an integrated suite of solutions that connect invoice automation, supplier management, procurement, and analytics, all purpose-built for finance leaders.

Discover how Medius helps CFOs gain full visibility, reduce risk, and optimize working capital across the entire procure-to-pay lifecycle.

Book a personalized demo to see how Medius empowers your AP team and drives measurable value for the enterprise.