Why is AP automation important for enterprise organizations?

Let’s face it. If you are a large, multinational business, you grapple with unique challenges in your financial operations. Operating across borders, managing a large workforce, and dealing with disparate systems and processes are just a few of the hurdles you face.

Just because your company is big doesn't mean you're destined for inefficiency and financial chaos. Thankfully, there are automation solutions that can really save the day, year, and bottom line for enterprise-level organizations. Accounts payable automation solutions – that leverage the power of AI and autonomous processes – are true heroes for today’s CEOs, CFOs, and other business leaders.

Here’s why AP automation is a game changer for large enterprise companies:

Happy employees worldwide

Employee satisfaction can greatly impact a business. Recent research from Medius found that 58% of finance professionals in the US and 71% in the UK are looking for a new job, and more than 50% say they are burnt out.

Staffing challenges are common in big businesses; if your business is global, those challenges get magnified. If you have a big AP team or outsource, you're likely dealing with high staffing expenses. And if you have a small team handling loads of invoices, chances are you're facing frequent staff turnover and burnout—leading to extra costs and time.

But when you implement AP automation that fits your business needs, your AP team's challenges and costs drastically change. Why? Because the day-to-day becomes a lot easier with solutions that improve workflows, reduce manual data entry and errors, and equip them to manage large invoice volumes with ease.

This means less turnover in finance teams, more strategic focus for leaders, and efficiencies across global operations. It means your people are happy, which drives productivity and benefits throughout your business.

What are the main impacts of automation on the role of the finance professional?

Pleased suppliers and partners

Is your team tired of repetitive calls or emails from suppliers asking about late payments or discrepancies? It’s common in big businesses to have friction and multiple supplier challenges. Decentralized systems and processes cause confusion between internal teams and external partners, which can wreak havoc on your AP team and supplier relationships.

With AP automation, you can resolve chaos with a singular, automated platform that can easily manage all of your supplier invoices and data. AI-backed AP solutions can manage global tax, currencies, and regulations efficiently and reduce the number of invoice errors and discrepancies.

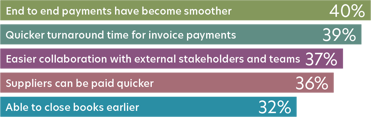

Plus, AP automation solutions that integrate with your accounting and ERP systems make workflow processes much more efficient –reducing bottlenecks, increasing visibility, and so much more. Suppliers are paid on time, which means they are happy – so your team and business are happy, too.

Simplified global operations

Running a global business comes with its own operational needs and challenges. Financial operations, especially, become complex when considering different jurisdictions, systems, languages, currencies, and tax factors.

The right AP automation solutions make all these challenges much easier when they manage multiple languages and currencies. Compliance becomes easier with a single platform that can grow and scale to meet the needs of a big business. Simplify is the key word to remember.

Simplifying global finance operations makes your AP processes smooth and efficient– from beginning to end.

Easy cross-border compliance

Security and compliance are top priorities for enterprise business, and financial security is a must. Risks such as fraud, weak encryption, and limited visibility can compromise sensitive data and financial integrity.

With AP automation that supports various multinational taxes, optimizes BPO processes, and manages government e-invoicing requirements, your business – no matter how big–can be confident in AP cross-border compliance.

Automation is pivotal in enhancing compliance within AP operations by streamlining processes, reducing human errors, and ensuring adherence to regulatory standards.

Dive into the following areas here.

Invoice automation

Payment automation

Fraud & risk detection

Supplier onboarding

Sourcing and procurement

Contract management

Analytics

Visible savings and cash flow

Ask any CFO at a big company about their main challenges, and chances are, they'll talk about the visibility of spend and cash flow. This rings especially true for larger businesses with complex operations.

Disparate systems and data management, increasing internal, invoice, and payment fraud threats, and unmet working capital and cash flow demands are some of the challenges that lead to limited visibility.

What you need is an AP automation solution that can take all cash flow data and give you a full analytics suite—right in one platform. Being able to see all your payment terms and suppliers' data and spot any potential fraud threats or policy mishaps will genuinely change your view.

When you get what you need from across all locations and systems into one view – you can actually prevent overspending, reduce reliance on credit, and get the visibility you need to:

- Focus on strategic growth initiatives.

- Optimize working capital and cash flow management.

- Get answers when you need them.

- Eliminate surprise expenses, unnecessary spending, and fraud.

- Motivate your team with strategic projects, not manual, frustrating tasks.

Benefits beyond just finance

While AP automation significantly impacts financial operations, the morale of finance teams, and the efficiency of financial processes, its benefits extend far beyond the finance department, including procurement, IT, HR, legal teams, and much more. How?

Enhanced data accuracy and accessibility empower leaders to make informed decisions.

Real-time insights and reliable financial data improve strategic planning and operational efficiency.

AP automation with robust fraud detection minimizes financial risk, cuts costs, and enhances security for HR, legal teams, and C-suite leaders.

Modern AP automation solutions seamlessly integrate with existing systems, reducing IT workload.

Automation reduces the burden of repetitive tasks, freeing up employees for more meaningful work. This morale boost extends to HR, fostering a positive work environment and higher retention rates.

Departments, like procurement, collaborate more effectively with centralized and transparent AP processes.

Timely and accurate payments build trust and strengthen supplier relationships, leading to better negotiation terms and a more resilient supply chain.

Scalable AP automation solutions support organizational growth, handling increased transaction volumes and complexity for sustained efficiency.

Hopefully, by now, it’s clear how AP automation benefits a large enterprise company. Sure, it’s a smart technology investment upgrade, but it’s so much more. From happy employees and content suppliers to smooth global operations and better compliance, it’s a gift that keeps on giving.

Explore how Medius is helping large companies like yours realize ROI every day with its innovative AP automation solutions.