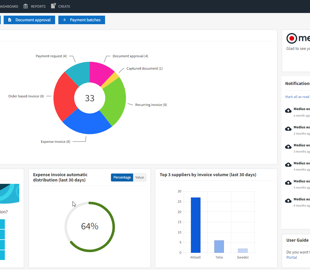

What is a business case for AP automation?

A business case for AP automation is an internal project that collects all the information needed to evaluate the costs and benefits of automating accounts payable processes. It should analyze how AP automation can improve payment accuracy, reduce manual processing time and effort, lower transaction costs, increase visibility into the AP process and enhance data security. The goal is to help relevant stakeholders understand how AP automation will benefit your organization.