How to choose the best AP Automation software for your business

When it comes to financial management, the efficiency of accounts payable (AP) processes is a key concern for CFOs, Finance Directors, Accounts Payable Managers, and IT Managers alike. The decision to implement an AP automation solution is not just about adopting new technology but also about choosing a system that enhances operational efficiency, reduces errors, and drives cost savings.

Recent trends and studies indicate a significant shift in the responsibilities of finance departments. Many finance leaders anticipate an increase in AP responsibilities and a surge in the volume of supplier invoices. These insights underscore the critical need for effective AP automation software that can scale with these evolving demands.

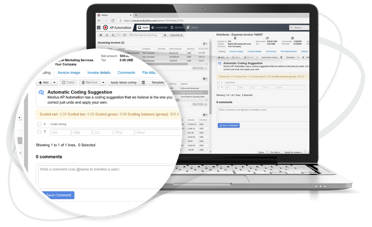

At Medius, we understand these challenges intimately. Our AP automation solutions are designed not just to meet but to exceed the needs of modern finance departments. With a focus on user-friendliness, seamless integration, and robust security, Medius stands out as a solution that aligns with the strategic goals of organizations.

In this guide, we will explore the essential considerations for choosing the best AP automation software. From defining your project scope to identifying key features that make an AP automation solution stand out, we aim to provide a comprehensive roadmap for making an informed decision that aligns with your business objectives. Let's begin by exploring why accounts payable (AP) automation is becoming increasingly essential.

Understanding the need for AP Automation

Understanding the need for AP automation becomes essential for any organization looking to enhance its financial operations. For decision-makers like CFOs, Finance Directors, Accounts Payable Managers, and IT Managers, recognizing the value of AP automation is the first step towards a more efficient, error-free, and cost-effective accounts payable process. Recognizing the need for AP automation is just the start; the evolving landscape of financial management further highlights its importance.

The shift in financial management

The landscape of financial management is evolving rapidly. A study highlighted by Stampli indicates that 76% of finance leaders are bracing for an increase in AP department responsibilities, with 71% expecting to handle a larger volume of supplier invoices. This trend points towards a growing need for solutions that can handle increased workload and complexity without compromising efficiency or accuracy.

Common pain points in AP processes

Traditional AP processes often involve manual data entry, paper-based invoice processing, and lengthy approval workflows. These methods are not only time-consuming but are also prone to errors, leading to delayed payments and strained supplier relationships. Automating these processes can significantly reduce the time and resources spent on manual tasks, allowing teams to focus on more strategic activities. While addressing these common pain points, AP automation also brings strategic advantages.

Strategic benefits of AP Automation

The role of accounts payable (AP) extends far beyond traditional transaction processing. AP automation is not just a tool for operational streamlining but it is also a strategic asset that can significantly enhance various facets of business performance. This shift from a purely functional role to a strategic one is crucial in understanding the full spectrum of benefits offered by AP automation software.

AP automation offers more than just operational efficiency. It provides strategic advantages such as:

- Enhanced visibility: Automated systems offer real-time insights into financial data, enabling better decision-making.

- Cost savings: By reducing manual tasks, organizations can save on labor costs and avoid penalties associated with late payments.

- Scalability: Automation solutions can easily scale with the growth of the business, ensuring that the AP processes remain efficient regardless of the volume of transactions.

Now that we understand the importance of AP automation, let's explore the steps on our roadmap:

Step 1: Define your scope for AP Automation

Step 2: Map your current AP process to identify your needs

Step 3: Know the key features to look for in AP Automation software

Step 4: Evaluate and compare AP Automation solutions

Step 5: Make the decision (choose the best AP Automation software)

Step 1

Define your scope for AP Automation

Defining the scope of your AP automation project is the foundational step in this process. This stage is about clearly outlining your objectives and what you aim to achieve with AP automation. For CFOs, Finance Directors, Accounts Payable Managers, and IT Managers, it involves aligning the project's goals with the broader financial and operational goals of the organization.

Identify key stakeholders

Identify key stakeholders

Involving the right people from the start is essential. This includes representatives from finance, IT, and accounts payable. Each of these groups will have unique insights and requirements that are critical to the success of the project. Medius emphasizes the importance of stakeholder engagement, ensuring that the solution chosen meets the diverse needs of all departments involved.

Agree on project scope

Agree on project scope

Once stakeholders are identified, the next step is to agree on the project scope. This involves defining what the AP automation solution needs to achieve. Are you looking to improve invoice processing times, enhance data accuracy, or reduce operational costs? Setting specific and measurable goals at this stage will guide the decision-making process and help in evaluating the success of the project.

Set measurable goals

Set measurable goals

The goals set should be Specific, Measurable, Achievable, Relevant, and Time-bound (SMART). For example, reducing invoice processing times by 50% within six months is a SMART goal.

Understand your current process

Understand your current process

A thorough understanding of your current AP process is crucial. This includes identifying bottlenecks, understanding the flow of invoices, and recognizing areas where errors commonly occur. Medius recommends a detailed mapping of the current process to identify these key areas, which will inform what features and capabilities are most needed in an AP automation solution.

In this phase, it’s not just about choosing a tool; it’s about laying the groundwork for a solution that will bring long-term value to your organization. By clearly defining your scope and setting measurable goals, you ensure that the AP automation solution you choose aligns with your organization's needs and objectives.

With a clear scope and goals set, the next step is to dig into your current operations. Step 2 involves a detailed mapping of your existing AP process to identify specific needs and challenges.

Step 2

Map your current AP process to identify your needs

A critical step in selecting the right AP automation solution is to thoroughly map your current accounts payable process. This step is vital for understanding the specific challenges and requirements of your organization, allowing you to choose a solution that addresses these needs effectively.

Identify pain points

Identify pain points

Begin by pinpointing the top challenges in your current AP process. Common issues include delayed invoice processing, manual data entry errors, and inefficient approval workflows. By identifying these pain points, you can focus on finding an AP automation solution that specifically addresses these areas. Medius recommends a detailed analysis of your current process to uncover these critical issues.

Analyze invoice workflow

Analyze invoice workflow

Examine your current invoice processing workflow. How are invoices received, processed, and approved? Are there unnecessary steps or bottlenecks that could be streamlined? Understanding the flow of invoices from receipt to payment is crucial in selecting an AP automation solution that can optimize these processes.

Evaluate integration needs

Evaluate integration needs

Consider how the AP automation solution will integrate with your existing systems, such as ERP (Enterprise Resource Planning) software. Seamless integration is key to ensuring a smooth transition and continued efficiency. Medius offers solutions that are designed to integrate effortlessly with a variety of systems, ensuring a cohesive and efficient workflow.

Assess volume and scalability

Assess volume and scalability

Assess the volume of invoices your department handles and anticipate future growth. It's important to choose a solution that not only meets your current needs but is also scalable to accommodate future increases in invoice volume.

By mapping your current AP process and understanding your specific needs, you can make an informed decision when choosing an AP automation solution. This step ensures that the solution you select not only addresses your current challenges but also supports your organization's growth and evolution.

Having thoroughly analyzed your current AP process, you are now equipped to identify what's crucial in an AP automation solution. Step 3 focuses on the key features that should guide your selection.

Step 3

Know the key features to look for in AP Automation software

Choosing the best AP automation software for your organization involves understanding the key features that drive efficiency, accuracy, and strategic value. Here are the essential features to consider, ensuring that the solution you select not only meets your current needs but is also equipped for future challenges.

Integration capabilities

Integration capabilities

One of the most critical aspects of any AP automation software is its ability to integrate seamlessly with your existing financial systems, such as ERP software. Medius offers robust integration capabilities, ensuring that data flows smoothly between systems, reducing manual data entry, and minimizing errors.

User-friendly interface

User-friendly interface

A user-friendly interface is crucial for high adoption rates among your team. The software should be intuitive and easy to navigate, reducing the learning curve and increasing efficiency.

Scalability

Scalability

As your business grows, your AP automation solution should grow with you. Scalability is a key feature, allowing the software to handle increasing volumes of invoices and more complex financial operations without a drop in performance.

Real-time analytics and reporting

Real-time analytics and reporting

Access to real-time data and comprehensive reporting tools is essential for informed decision-making. Medius’s AP automation solutions offer detailed analytics and reporting capabilities, giving you valuable insights into your AP processes and financial health.

Security and compliance

Security and compliance

With the increasing importance of data security and regulatory compliance, ensure that the AP automation solution adheres to industry standards and regulations. Medius’s solutions are designed with security and compliance at their core, providing peace of mind and protecting sensitive financial data.

Cost-effectiveness

Cost-effectiveness

Evaluate the cost-effectiveness of the solution, considering not only the initial investment but also the long-term ROI. Medius’s AP automation software is designed to provide significant cost savings by reducing manual labor, minimizing errors, and streamlining processes.

By focusing on these key features, you can ensure that the AP automation solution you choose will bring substantial benefits to your organization. The right solution will not only address your immediate needs but also provide a foundation for continuous improvement and growth in your AP processes.

Understanding the essential features of AP automation software paves the way for the next critical phase: evaluating and comparing the available solutions. In Step 4, we'll look at how to approach this vital selection process.

Step 4

Evaluate and compare AP Automation solutions

Once you have a clear understanding of your needs and the key features to look for, the next step is to evaluate and compare different AP automation solutions. This process is crucial in making an informed decision that aligns with both your immediate requirements and long-term strategic goals.

Create a shortlist of vendors

Create a shortlist of vendors

Start by creating a list of potential AP automation software vendors. Consider recommendations, industry reviews, and research to compile a list of solutions that meet your basic criteria.

Request demonstrations and trials

Request demonstrations and trials

Reach out to the vendors for demonstrations and, if possible, trial periods. This hands-on experience is invaluable in understanding how each solution works in practice and how well it integrates with your existing systems.

Compare features and benefits

Compare features and benefits

Use a structured approach to compare the features and benefits of each solution. Focus on how each software addresses your identified pain points, its scalability, user-friendliness, integration capabilities, and the level of customer support offered.

Customer reviews and testimonials

Customer reviews and testimonials

Look for customer reviews and testimonials to gauge the satisfaction of current users. These insights can provide real-world evidence of the software’s performance and the vendor’s reliability. Medius’s customer success stories, for instance, highlight the tangible benefits and improvements experienced by its users.

Analyze total cost of ownership

Analyze total cost of ownership

Evaluate the total cost of ownership (TCO) of each solution, which includes not only the initial purchase price but also ongoing costs such as maintenance, support, and upgrades.

By meticulously evaluating and comparing AP automation solutions, you can make a decision that brings efficiency, accuracy, and strategic value to your organization’s AP processes. The right choice will serve as a cornerstone in your journey towards digital transformation and operational excellence.

After carefully evaluating and comparing your options, it's time to make the pivotal decision. Step 5 is all about synthesizing the information gathered and selecting the best AP automation solution for your business.

Step 5

Make the decision (choose the best AP Automation software)

After thoroughly evaluating and comparing different AP automation solutions, the final and arguably most crucial step is making the decision. This stage is about synthesizing the information gathered, weighing the pros and cons, and choosing a solution that aligns best with your organization's specific needs and goals.

Synthesize information

Synthesize information

Review the data collected during your evaluation process. Consider how each solution stacks up against your list of requirements, and reflect on the feedback from demonstrations and trials.

Weigh the pros and cons

Weigh the pros and cons

Every solution will have its strengths and weaknesses. It's essential to balance these against your organization's priorities. What aspects are non-negotiable for your business, and where can you afford to compromise?

Consider long-term impact

Consider long-term impact

Think beyond the immediate benefits. How will this solution grow with your organization? Assess the scalability, future updates, and the vendor's track record for innovation and customer support.

Align with organizational goals

Align with organizational goals

Ensure that the solution you choose aligns with your broader organizational objectives. How does it fit into your overall financial strategy and business model?

Seek stakeholder buy-in

Seek stakeholder buy-in

Before finalizing the decision, it's crucial to have the buy-in from key stakeholders. This includes not just the finance and IT departments, but also top management who will approve the investment.

Make an informed choice

Make an informed choice

With all the information and insights at hand, make an informed choice. Remember, the best AP automation software for you is one that not only addresses your current challenges but also supports your future growth and success.

Next steps

Next steps

Once the decision is made, plan for the next steps. This includes negotiating with the vendor, planning the implementation process, and preparing your team for the transition.

Choosing the best AP automation solution is a significant step towards enhancing your financial operations' efficiency and strategic value. By carefully considering all factors and making an informed decision, you set your organization on the path to streamlined processes, improved accuracy, and enhanced financial insights. With these steps, you are well-equipped to make an informed decision. As you move forward, consider how a partner like Medius can facilitate this journey.

Ready to elevate your AP processes? Take the next step with Medius.

You're now equipped with the knowledge to transform your accounts payable operations. But why stop here? Dive deeper and make your journey towards AP automation a resounding success with Medius.

Download our comprehensive buyer's guide

For a more detailed analysis and a handy checklist to guide your evaluation, download Medius's Buyer's Guide to AP Automation Solutions. This guide is your roadmap to understanding the nuances of AP automation and ensuring you make the best choice for your business.

Explore Medius's AP Automation solution

Curious about how Medius can specifically cater to your needs? Visit our solution page to learn more about Medius Accounts Payable Automation. Discover how our solution stands out in the market with its unique features and benefits, tailored to streamline and enhance your financial operations.

Book a personalized demo

Seeing is believing. Schedule a personalized demo of Medius software to witness firsthand how our solution can revolutionize your AP processes. Our experts are ready to walk you through the functionalities and answer any questions you may have.

Your journey towards efficient, streamlined, and error-free accounts payable processes begins with Medius. Embrace the change and let us help you achieve financial excellence and operational efficiency. The future of AP automation is just a click away!