Embracing the Future: Latest Trends in AP Automation

With each passing year, new innovations in AP automation are reshaping how businesses manage their finances, offering fresh perspectives and solutions in the dynamic world of accounts payable.

AI and machine learning - Revolutionizing invoice processing

Artificial Intelligence (AI) and Machine Learning (ML) are redefining AP processes. By utilizing AI, AP automation systems can efficiently learn from historical data for more accurate invoice matching, anomaly detection, and predictive analytics. These technologies represent a significant upgrade from traditional, rule-based AP systems, enhancing efficiency in processing complex transactions.

This is the real promise of AI and machine learning within accounts payable — not just streamlining processes but eliminating them. This is where many AP managers and financial leaders want to move with their AP processes. SSON found that only 14% of respondents at the 2024 AP Automation Virtual Summit are currently using AI in the accounts payable processes, and nearly 41% reported no plans to implement it in the future. This leaves incredible opportunity for improved efficiency and cost savings on the cutting room floor, a decision that many organization can't afford to make.

Cloud-based solutions - Flexibility and scalability

The adoption of cloud-based accounts payable automation solutions is on the rise, reflecting the latest in accounts payable technology. These platforms provide tremendous flexibility, enabling businesses of various sizes to effortlessly scale their AP operations. Cloud-based systems support remote access, real-time data synchronization, and smooth integration with other financial systems, fostering a comprehensive approach to financial management.

Mobile accessibility - AP management on the go

Mobile accessibility is transforming the way financial teams interact with AP automation systems. This feature allows for efficient invoice approvals and financial oversight from anywhere, ensuring that businesses remain agile and responsive in a rapidly evolving market.

Enhanced security measures - Safeguarding financial data

With the advancement of accounts payable automation technology, security measures to protect sensitive financial data have also evolved. Implementing advanced encryption, multi-factor authentication, and continuous monitoring has become a norm, providing businesses the confidence to adopt digital AP solutions.

The advancements in AP automation, from AI-enhanced processing to mobile accessibility, are integral to staying competitive. Embracing these innovations enables businesses to refine their accounts payable processes, ensuring efficiency, security, and strategic financial management.

Navigating the sophistication: Advanced features of AP automation

Modern AP automation solutions are transforming how businesses handle their finances, offering a suite of advanced features that streamline operations and elevate financial management.

Real-time analytics - Empowering data-driven decisions

Contemporary AP automation systems are equipped with real-time analytics, enabling businesses to gain immediate insights into their financial operations. This feature allows for the identification of spending trends and supports informed, strategic decision-making in the accounts payable domain. This maps well with what the market is saying, as more than half of the respondents in Ardent Partners’ 2023 State of ePayables report stated that reporting and analytics were their main focus for the year ahead.

Fraud detection - Enhancing financial security

Advanced algorithms for fraud detection are now integral to AP automation systems. These tools proactively identify unusual patterns and potential fraud, safeguarding a company's financial assets and upholding the integrity of financial processes.

Seamless system integration - Streamlining operations

Modern accounts payable automation solutions, or AP invoice automation systems, offer extensive integration capabilities with various ERP systems, HR platforms, and financial software. This harmonization streamlines operations, minimizes data entry errors, and ensures consistency across financial management systems.

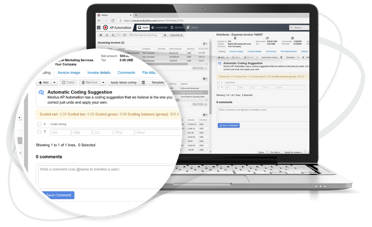

Customizable workflows - Adapting to unique business needs

The ability to customize workflows is a key feature of sophisticated AP automation systems. Businesses can adapt these workflows to align with their specific operational processes and rules, ensuring a seamless fit with their organizational structure.

Automation carrying through to payments

The move to a holistic invoice through payment approach to digital transformation has been steadily increasing year over year, and it’s a strategy that’s paying off for the businesses who took that route early on. Out of all respondents surveyed for Ardent Partners’ Pulse of B2B payments, time and cost savings were overwhelmingly the top benefits from optimizing their supplier payment processes.

The benefits of an advanced AP automation software that can handle all types of payments – ACH, virtual cards, wire transfers, checks and even cryptocurrencies – means a seamless process and the ability to see in real time when is the right time to pay. It also keeps track of invoice data over a vendor’s lifecycle, which makes it easier to spot patters for better forecasting and cashflow management, and to spot when a mistake or potential fraud attempt is happening.

The advanced features of modern AP automation systems, from real-time analytics to customizable workflows, are reshaping the approach to accounts payable management. These technological enhancements not only bring efficiency and security but also adaptability, positioning AP automation as an essential tool for progressive organizations.

Interested in discovering how these features can transform your accounts payable process? Explore Medius' Accounts Payable Automation solution, where innovation meets practicality. Learn more about how our specific features can cater to your unique business needs and drive operational excellence.

Peering into the future: What lies ahead for AP automation

The landscape of accounts payable technology, including AP invoice automation, is poised for exciting advancements. As technology advances, new opportunities emerge for businesses to further streamline and secure their accounts payable processes. Let's explore the innovations that are shaping the future of AP automation.

Artificial intelligence and machine learning

The integration of AI and Machine Learning in AP automation is transforming invoice processing and financial decision-making. These technologies enable more accurate predictions of cash flow, enhance fraud detection, and automate complex decision-making processes. They are set to make AP systems not just faster, but smarter, adapting to business patterns and behaviors.

Blockchain technology

Blockchain technology promises to revolutionize AP automation with its inherent security and transparency features. It offers an unalterable ledger of transactions, providing undeniable accuracy and trust in financial records. This technology could significantly streamline contract management, payments, and reconciliation processes in AP.

Increased integration and interoperability

The trend towards more integrated and interoperable systems is gaining momentum. Future AP automation solutions are likely to offer even smoother integrations with a wider array of business systems – from ERP platforms to procurement and HR systems. This interconnectedness will enable a more unified view of business finances and operations.

The rise of mobile and remote access

Mobile access is increasingly becoming a staple in AP automation solutions, reflecting the modern workforce's need for flexibility and on-the-go access. This shift enables finance teams to manage invoices, approvals, and payments anytime and anywhere, thus enhancing efficiency and responsiveness.

Emphasis on data security and compliance

As AP automation solutions become more digitally oriented, the emphasis on data security and regulatory compliance will intensify. Future solutions will need to be equipped with advanced security measures to protect sensitive financial data and comply with evolving financial regulations and standards.

The future of AP automation is undoubtedly exciting, marked by technological advancements that promise to make accounts payable processes more efficient, secure, and intelligent. As these technologies evolve, businesses that stay ahead of the curve will find themselves in a position of strength, with streamlined financial operations and enhanced strategic capabilities.