How do banks investigate unauthorized transactions?

- Introduction

- What is bank fraud investigation?

- The imperative of bank investigations in preventing fraud

- How do banks investigate unauthorized transactions?

- The role of automation in fraud detection

- The role of Suspicious Activity Reports (SARs) in fraud investigations

- How long does a bank fraud investigation take?

- Fraud investigation process in banks

- Who is liable for credit card and ACH fraud?

- Business liability & consequences of bank fraud

- The critical role of businesses in fraud prevention

- The impact of fraud on businesses and consumers

- Adopting AP automation to mitigate fraud

- Safeguard your business against financial fraud

- FAQs

Hear what's covered in this article:

In the intricate world of financial security, understanding how banks investigate unauthorized transactions is crucial for both individuals and businesses. As the risk of fraud becomes more prevalent than ever, understanding the mechanisms behind fraud detection and investigation is imperative. This article explores the various facets of bank investigations, highlighting key processes and timelines involved in these critical endeavors.

What is bank fraud investigation?

A bank fraud investigation is a thorough examination conducted by financial institutions to detect, analyze, and determine the origin, method, and impact of fraudulent activities within banking operations. This process involves scrutinizing suspicious transactions, verifying the authenticity of financial documents, and employing advanced detection techniques to protect customers' assets and the integrity of the banking system.

The imperative of bank investigations in preventing fraud

Banks play a pivotal role in safeguarding financial assets and maintaining the trust of their customers. Unauthorized transactions, ranging from minor discrepancies to substantial fraudulent activities, pose a significant threat to the financial stability of individuals and institutions alike. Banks, therefore, employ comprehensive investigation procedures to combat fraud, protect their customers, and preserve their own credibility.

How do banks investigate unauthorized transactions?

Initial detection of fraudulent activity

Banks use advanced detection systems to monitor transactions and flag anomalies based on frequency, amount, and location. If a customer suspects fraud, they should report it immediately, providing transaction details to assist in the investigation. Updating passwords, enabling two-factor authentication, and monitoring accounts can help prevent further unauthorized access while aiding investigators in mitigating risks.

Manual investigation and analysis

Once a potential fraudulent transaction is flagged, banks deploy specialized investigation teams. These professionals, often with backgrounds in finance and cybersecurity, examine the electronic trails of transactions and apply account-based rules to trace the origin of the suspected fraud.

The role of automation in fraud detection

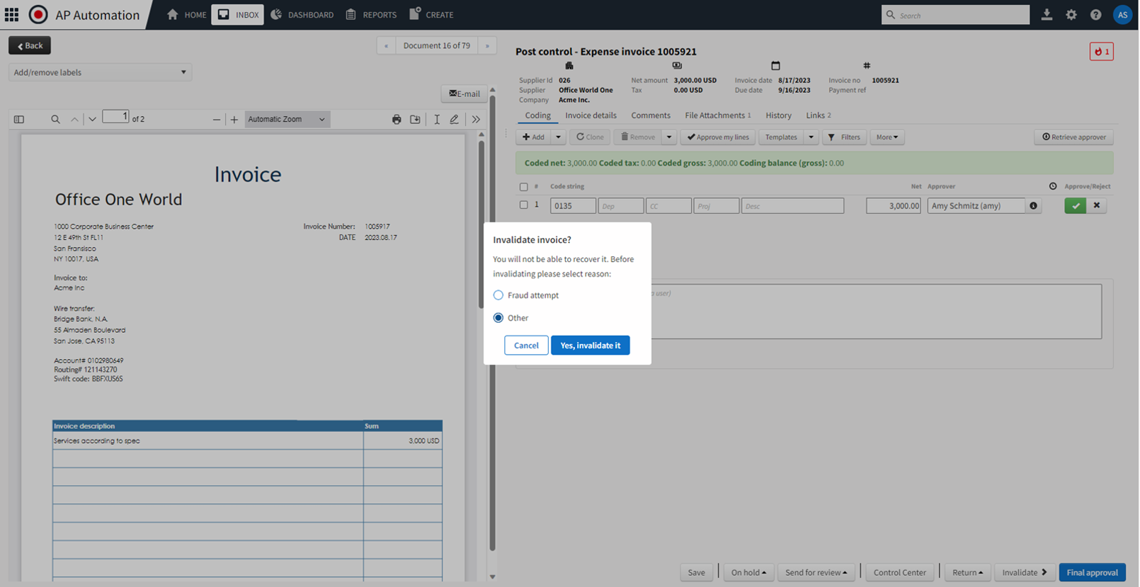

Automation plays a critical role in enhancing the efficiency and accuracy of fraud detection. Financial institutions employ advanced software solutions that can instantly identify inconsistencies in transactions. These systems base their alerts on deviations from standard transaction behaviors and unexpected changes in critical information like payment details or supplier credentials.

Get a deeper look into AI‑powered fraud detection.

The role of Suspicious Activity Reports (SARs) in fraud investigations

Banks are legally required to report suspected fraud by filing Suspicious Activity Reports (SARs) with regulatory authorities. These reports serve as a key link between financial institutions and law enforcement, such as the FBI, to investigate fraudulent activities.

When a suspicious transaction is flagged, banks conduct an internal review before deciding whether an SAR is necessary. Once filed, law enforcement can use SAR data to track fraud patterns, identify large-scale fraud rings, and prevent future financial crimes.

Medius Fraud & Risk Detection helps businesses identify fraud risks before an SAR is even required, reducing exposure to financial and legal risks. By using AI-driven invoice anomaly detection and automated risk tracking, companies can stop fraud before it escalates into a regulatory issue.

How long does a bank fraud investigation take?

The duration of a bank fraud investigation can vary widely, typically ranging from 30 to 90 days. This timeline depends on the complexity of the case, the amount of evidence to be gathered, and the level of collaboration required with external entities such as law enforcement agencies.

Fraud investigation process in banks

Examining the process of fraud investigation within banks reveals a meticulous and multi-layered approach essential for safeguarding financial integrity. This journey into the heart of bank fraud investigations uncovers the systematic steps financial institutions undertake to unravel and address unauthorized transactions. The very fabric of these investigations is woven with a mix of technological prowess, regulatory adherence, and expert human analysis. As we examine this process further, it becomes evident that the battle against fraud is not only about identifying irregularities but also about understanding the intricate interplay between various elements that constitute a bank's defense mechanism against financial deception.

At the core of this process lies a blend of vigilance, expertise, and technology. Banks employ a series of well-structured steps to ensure that every suspicious transaction is scrutinized, every complaint is addressed, and every anomaly is investigated with precision. From the moment a red flag is raised, either through automated systems or customer reports, to the final resolution of the case, each step is critical in piecing together the puzzle of fraudulent activity. The upcoming list provides a detailed insight into these key stages, offering a clear perspective on how banks maneuver through the complex terrain of fraud investigations.

Receipt of fraud alert or complaint

The investigation process often begins with an alert generated by the bank's monitoring systems or a complaint filed by a customer regarding an unauthorized transaction.

Evidence gathering and analysis

Investigators gather evidence, which may include transaction records, communication logs, and customer account histories. This phase is crucial in identifying the nature and extent of the fraudulent activity.

Collaboration with law enforcement

In severe cases of fraud or identity theft, banks may involve law enforcement agencies. This step is essential for broader investigations that may have implications beyond the bank's jurisdiction.

Who is liable for credit card and ACH fraud?

Understanding liability in the context of credit card and Automated Clearing House (ACH) fraud is crucial. Generally, the burden of liability falls predominantly on merchants. They are often required to issue refunds for disputed payments, which can include charges related to unauthorized transactions, non-delivery of goods or services, or billing errors. This process is not just a matter of rectifying inaccuracies but also serves as a deterrent against negligent practices.

Subsequently, banks play a pivotal role by imposing fees or chargebacks on the merchants. This action by banks is not merely a punitive measure but also a regulatory requirement to maintain a fair and secure financial environment. It underscores the banks' role in maintaining transaction integrity and holding merchants accountable for adhering to secure transaction practices. By enforcing these measures, banks not only protect the consumers but also reinforce a culture of vigilance and responsibility among merchants.

Business liability & consequences of bank fraud

Many businesses mistakenly believe that fraud prevention is solely the bank’s responsibility. However, when internal controls are weak, companies themselves can be held accountable for fraudulent activity, facing fines, compliance violations, and financial setbacks.

Regulatory bodies and financial institutions expect businesses to implement fraud detection measures, such as verifying suppliers and monitoring invoices for anomalies. Failure to do so can result in audits, penalties, or even legal action under anti-money laundering (AML) and fraud prevention laws. Additionally, businesses that repeatedly process fraudulent transactions may incur chargebacks or restrictions from their banking partners, limiting financial flexibility.

With Medius Fraud & Risk Detection, businesses can proactively safeguard their operations by identifying suspicious transactions early, ensuring compliance, and preventing unnecessary financial and legal consequences. Instead of reacting to fraud after it happens, Medius helps companies stop it before it becomes a liability.

The critical role of businesses in fraud prevention

While banks deploy sophisticated systems for detecting and investigating fraud, the onus of fraud prevention also heavily rests on businesses. In today's digital age, where financial transactions are intertwined with technology, businesses must adopt robust policies for detecting, reporting, and investigating fraud. This responsibility extends beyond mere compliance; it is an integral part of ethical business conduct.

Businesses, by training employees in fraud detection and investing in accounts payable (AP) automation, can significantly bolster the banks' efforts in fraud prevention. Such proactive measures not only help in early detection of irregularities but also in swiftly addressing potential threats, thus reducing the time and resources banks need to spend on investigations. This symbiotic relationship between businesses and banks enhances the overall security of the financial ecosystem, making it more resilient against fraudulent activities.

The impact of fraud on businesses and consumers

The repercussions of fraudulent transactions are profound and multifaceted, affecting both businesses and consumers. Financial losses are just the tip of the iceberg. The more significant damage often lies in the erosion of brand reputation and customer trust. When consumers encounter fraud, their confidence in the affected business dwindles, which can lead to a decline in customer loyalty and, consequently, profitability.

This scenario underscores the interconnectedness between businesses and banks in managing fraud. Banks, while serving as guardians of financial transactions, rely on businesses to maintain stringent security practices. A lapse on either end can lead to detrimental outcomes. Therefore, mitigating fraud is not just a regulatory requirement but a critical aspect of sustaining business viability and consumer confidence in the financial system.

Adopting AP automation to mitigate fraud

AP automation is increasingly recognized as a necessity in the fast-paced world of global commerce. By streamlining workflows, supporting remote operations, and enhancing fraud detection, AP automation solutions offer substantial benefits. These benefits include reduced risks, lowered operational costs, and improved supplier relationships, ultimately contributing to an organization's bottom line and brand loyalty.

Banks' role in investigating unauthorized transactions is a complex but crucial aspect of financial security. Understanding this process helps individuals and businesses appreciate the intricacies involved in fraud detection and prevention. However, it's essential to recognize that the responsibility for combating fraud extends beyond banking institutions. Businesses must proactively adopt appropriate measures and technologies to protect themselves and their customers from the growing threat of financial fraud.

Safeguard your business against financial fraud

While banks do their part, the responsibility of fraud prevention extends to businesses as well. Elevate your defenses with Medius's Fraud Risk and Detection solution. Our advanced AP automation tools are designed to detect anomalies early, enhancing your ability to protect against unauthorized transactions and fraud. Discover how our AI-driven technology can fortify your financial operations.

FAQs

What are the most common red flags for invoice fraud?

Invoice fraud often involves duplicate submissions, sudden supplier bank changes, invoices from unknown vendors, or pricing discrepancies. Another red flag is unusual invoice dates, such as backdated or postdated requests. Medius’s AI-powered fraud detection identifies these risks early, ensuring businesses catch fraudulent activity before payments are made.

How does AI improve fraud detection compared to traditional methods?

Traditional fraud detection relies on manual reviews and simple rule-based systems, making it easier for sophisticated schemes to slip through. AI-driven fraud detection analyzes vast transaction data, detects anomalies in real time, and continuously improves by learning from past fraud cases. Medius automates this process, reducing human error and catching fraud faster than manual reviews ever could.

Take command of spend, risk, and visibility

Accounts payable staff are on the front line of business change and often are tasked to implement cash flow policy changes in near real time. In many ways, AP has become the control tower for managing spend within the organization. However, many of them are stuck with legacy tools and outdated processes, creating massive inefficiencies. The real promise of AI and machine learning within accounts payable is not just streamlining processes but eliminating them.

This report from SSON explores how AP automation of today is evolving to become autonomous AP of tomorrow.