How to detect fraud transactions in accounts payable

Last updated on November 30, 2023

Fraud is a pressing concern for businesses, impacting both profits and brand reputation. A startling 95% of businesses have encountered invoice fraud in the last year, emphasizing the critical need for effective fraud detection in accounts payable. While some losses are irreparable or take years to recover from, proactive measures can significantly mitigate these risks.

Outdated manual processes are often the culprits, leaving ample room for fraudulent activities. On the other hand, cloud automation fosters a secure and collaborative environment, especially vital in today’s international business climate with a reliance on remote workers. Discover how AP automation plays a pivotal role in detecting and eliminating fraudulent transactions, ensuring the continuity of timely production.

How is transaction fraud detected?

Transaction fraud, an issue that 95% of businesses have encountered in the past year, is often unearthed through various channels. Traditional methods include employee tips, internal and external audits, management reviews, and sometimes, accidental discovery. Moreover, advanced fraud detection technologies have emerged as a cornerstone in identifying fraudulent transactions early.

By employing anomaly detection algorithms, organizations can spot irregularities swiftly, significantly reducing potential damage. Clear policies and robust protocols are imperative for guiding management and employees when fraud is discovered. Cloud AP automation further bolsters fraud detection, offering real-time tracking of transactions to catch fraud before it escalates into a costly issue.

By employing anomaly detection algorithms, organizations can spot irregularities swiftly, significantly reducing potential damage. Clear policies and robust protocols are imperative for guiding management and employees when fraud is discovered. Cloud AP automation further bolsters fraud detection, offering real-time tracking of transactions to catch fraud before it escalates into a costly issue.

Identifying fraud in accounts payable

Once organizations establish policies for identifying and reporting fraud, it's crucial to know how to identify fraudulent transactions in accounts payable. The team should closely analyze certain transactions to ensure they are valid and not fraudulent, including:

- Duplicate payments

- Fuzzy matching

- Rounded invoice amounts

- Supplier with a mail drop as an address

- Invoices just below approval

- Check theft search

- Above-average payments per supplier

- Abnormal invoice volume activity

- Vendor employee cross-checking

Additionally, leveraging updated statistics and technology can further aid in detecting fraudulent transactions. For instance, anomaly detection technology can highlight unusual transaction patterns, providing early warnings to prevent potential financial mishaps.

Manual processes leave room for human error and fraud, making the task of detecting fraudulent transactions more challenging. Additionally, the time-consuming nature of manual fraud checking can culminate in significant losses over a short time. AP automation facilitates real-time updates to detect fraud faster, allowing management to realize a measurable ROI within the first year of implementation, and plays a pivotal role in how to detect fraud efficiently.

Eliminating accounts payable fraud

Early detection is key to mitigating accounts payable fraud, a task made easier with fraudulent transaction detection technologies. Establishing standard policies for reporting, coupled with implementing AP automation, forms the backbone of a robust fraud prevention strategy. Moreover, fostering a culture of trust and collaboration between management, employees, and suppliers is pivotal; yet, only 42% of companies collaborate to prevent and catch payment fraud. Steps to avoid the repercussions of unchecked fraud include:

Validate important vendor data.

Establish a system of checks and regulations.

Use anomaly detection technology.

Leverage end-to-end invoice through payment automation.

With the aid of continuous cloud access to data through automation, fraud detection becomes quicker and more efficient, enabling timely reporting and supplier onboarding, which in turn facilitates informed decision-making when it matters most.

Latest trends in fraud detection technology

The landscape of fraudulent transaction detection is rapidly evolving with the advent of Artificial Intelligence (AI) and Machine Learning (ML). These technologies enable real-time analysis of transaction data, identifying anomalies and potential fraud with higher accuracy. Blockchain technology is also emerging as a reliable means of securing transaction data and ensuring authenticity.

The landscape of fraudulent transaction detection is rapidly evolving with the advent of Artificial Intelligence (AI) and Machine Learning (ML). These technologies enable real-time analysis of transaction data, identifying anomalies and potential fraud with higher accuracy. Blockchain technology is also emerging as a reliable means of securing transaction data and ensuring authenticity.

Also, predictive analytics empowers organizations to anticipate fraudulent activities by analyzing historical data and predicting future fraud patterns. Embracing these cutting-edge technologies can significantly enhance an organization’s defense against fraud, ensuring a secure transaction environment.

AP Automation: a modern solution to fighting fraud.

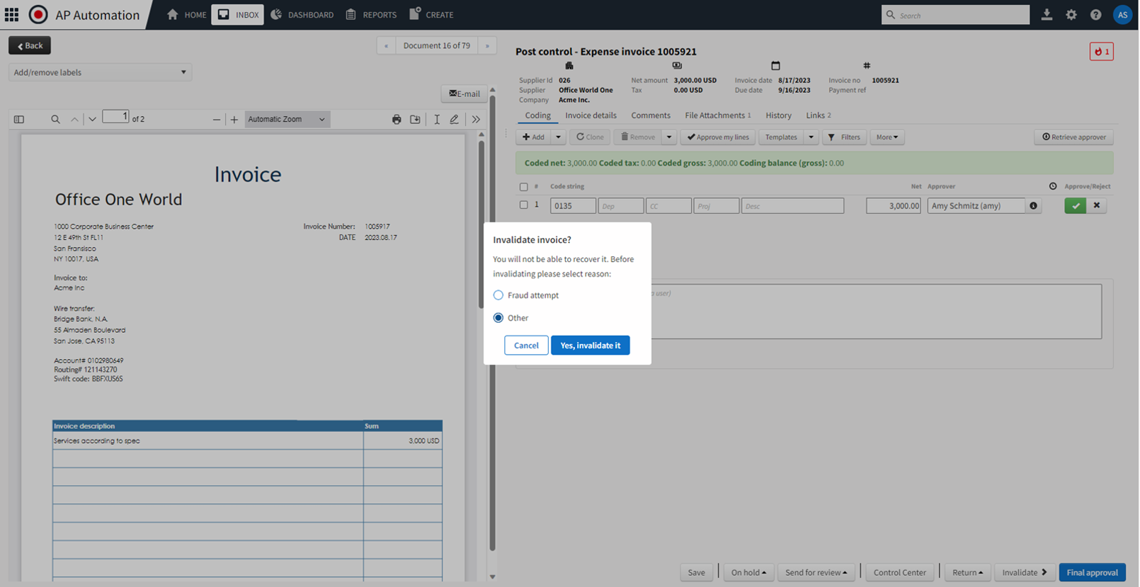

AP Automation, a modern solution to managing accounts payable processes, plays a critical role in fraudulent transaction detection and prevention. Here’s how:

Real-time monitoring

AP automation facilitates real-time monitoring of all transactions, making it easier to identify suspicious activities as they occur.

Data analysis

With the ability to analyze vast amounts of data quickly, AP automation helps in identifying patterns and anomalies that could indicate fraud.

Vendor verification

Automated systems can verify vendor information against established criteria to prevent fraudulent transactions from unauthorized vendors.

Approval workflows

Establishing automated approval workflows ensures that invoices go through the necessary checks before payments are authorized.

Document management

Centralized document management within an AP automation system ensures that all transaction records are securely stored and easily retrievable for auditing purposes.

Compliance adherence

AP automation helps in adhering to regulatory compliance by maintaining a clear audit trail of all transactions, thus reducing the risk of fraud.

Incorporating AP automation into your accounts payable processes not only streamlines operations but significantly bolsters your organization’s defenses against fraud. By reducing manual errors and providing a clear overview of all transactions, AP automation empowers organizations to tackle fraud head-on.

Take your fraud prevention to the next level with Medius AP Automation software.

Ready to enhance your fraud detection capabilities and streamline your accounts payable processes? Medius AP Automation Software is designed to provide real-time monitoring, data analysis, and robust compliance adherence, aiding in the early detection and prevention of fraudulent activities. With our software, you're not just investing in fraud prevention, but in a more secure and efficient operational framework for your organization.

Discover the features of Medius AP Automation software and take a significant step towards a fraud-free accounts payable environment.

Industry statistics on fraud

The pervasive issue of fraud continues to pose significant challenges across various industries. Here are some revealing statistics:

- A staggering 95% of businesses have witnessed invoice fraud in the last year.

- Globally, 34,000 cases of fraud were reported across the 2,750 businesses sampled.

- On average, businesses encounter 1 case of fraud per month, but 19% have seen as many as 30 cases in the last year.

- A concerning 25% of finance professionals are unable to estimate the cost of fraud to their organization, mainly due to unawareness of its occurrence.

- The remaining 75% estimate the cost of fraud to be well over a quarter of a million dollars annually.

- Shockingly, 57% of businesses report that the responsibility to combat fraud is not shared between finance and IT.

- Only a mere 42% of companies collaborate to prevent and catch payment fraud, highlighting a significant gap in fraud prevention strategies.

Navigating the path towards fraud-free transactions

Learning how to detect and prevent fraud transactions is crucial for an organization’s overall financial health and integrity. The utilization of AP automation not only streamlines the process but significantly enhances fraudulent transaction detection. Investing in AP automation software not only curtails fraud but also propels an organization towards a more secure and efficient operational framework.

Explore more about how to combat fraud and enhance your accounts payable process by contacting the professionals at Medius today, or dig deeper into this topic by downloading our Financial Professional Census report.